In 2010, The Business Council of British Columbia, an association representing approximately 250 major business enterprises, circulated a report on consumer impacts of HST written by SFU Professor Jon Kesselman. It purports to demonstrate that:

“the HST is not a “tax grab” and that its overall impact on the prices including taxes paid by consumers is very modest … “

Kesselman argued that prices of a number of items had fallen since implementation of the HST although he recognized that:

“Public skepticism on this point is widespread.”

The eoncomist noted that business saved $600 million each year in tax savings on BC-produced exports but claimed that amount should not be viewed as a gift. He did however agree that:

“…For companies selling products with prices fixed in world markets, the savings from the HST translate into improved profitability…”

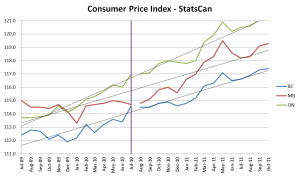

British Columbia and Ontario made HST effective in July 2010. Manitoba chose to continue with a separate provincial sales tax. It was one of the provinces Kesselman selected as a control to examine the degree of pass through savings. If the advocates of HST are correct that business will return its tax savings in the form of lower prices, then both British Columbia and Ontario should outperform Manitoba in the consumer price index. Well, here are the results, using Stats Canada monthly CPI reports by province, not seasonally adjusted.

Clearly, trend lines show that price increases in the two provinces that turned to HST have been higher than in Manitoba which stayed with dual sales taxes. Ontario has the highest rate of prices increases with BC second and Manitoba third. Kesselman, in his response to David Schreck’s critique of the professor’s paper for the business association, wrote:

The issue of whether, and to what extent, businesses have passed through their savings in the form of lower (or less rapidly increasing) prices is critical to assessing B.C.’s HST reform.

This CPI evidence suggests the pass through has not occurred as Kesselman argued. StatsCan reports support opponents of HST and their claims that the tax shift gave substantial benefit to business with no particular benefit realized by consumers. The provincial government’s stalling in reversal of the harmonized tax demonstrates that, contrary to Kesselman’s assertion, HST has been a “tax grab.” NDP small business critic Jagrup Brar introduced a motion asking the B.C. Liberal government to “fast-track elimination of HST. Liberal members refused to support the motion.

Another Kesselman statement in the report for the business council caught my eye:

‘With competitive product markets, one would expect the business taxes, like any component of cost, to be fully borne by consumers and their removal to be fully passed through to benefit consumers. To the extent that product markets are less than competitive, or oligopolistic with few suppliers of a given product, pass-through might be only partial.”

Of course, individuals with six-figure salaries might not be as aware as people of modest means that retail price levels in Canada compare badly with those of our southern neighbors. Largely, this is from concentrated ownership and lack of competition at the distribution level. The federal government helps maintain this situation with hopelessly weak laws respecting anticompetitive acts and, beyond that, erecting barriers at the border to inconvenience foreign shipments of goods direct to consumers.

Checking out products on Amazon.com and Amazon.ca, consumers find the same products offered north of the 49th parallel at prices often 50% to 75% higher. Amazon has been unable to add many products to its Canadian site without first agreeing to maintain prices comparable to other retailers in this country.

Zappos, an American online retailers of shoes, clothing and accessories recently stopped selling to Canadians and made this announcement:

“We have made the difficult decision to shut down the canada.zappos.com site and stop shipping to Canada…

“Product selection on canada.zappos.com is limited due to distribution agreements with the brands we sell in the United States. In addition, we have struggled with general uncertainty and unpredictability of delivering orders to our Canadian customers given customs and other logistics constraints…”

Canadians have grown used to paying substantially higher prices for automobiles — even those assembled in Canada for the USA — and electronics, clothing, furniture, appliances, fuel and auto parts, communication services, etc. The gap between Canadian and U.S. prices has widened for many goods despite a surge in the loonie that should reduce prices north of the border. In many cases the disadvantages suffered by Canadians can be traced to lack of competition and the strengths of American laws that restrict product distributors from imposing schemes of price management, schemes that are routinely tolerated in Canada.

Of course, that is a subject that the Business Council of British Columbia, and their academic handmaids, prefer to leave out of any discussion of prices.

Categories: HST

Smoke and Mirrors, the Great Con Game, call it what you will, all political parties play it, to a certain degree, some more than others.

The “challenge”, to the people of Canada, who are not involved in the game, is to sort out the lesser, of numerous evils and strike some kind of balance.

The system is flawed. The system was created to control and perhaps even coerce the voter to vote for the best “sounding pitch”, even though a far greater agenda is at play.

The price we as voters pay, perhaps through neglect on our part, is that “bad apples” do get by and into the system.

The penalties for infraction, in this game, are far too light. Deception and coersion of an electorate, in order to obtain power, is fraud and should be punished as such.

As Canadians, we don't seem to take this as seriously as we should. Its your rights and democracy that are being trampled. Many people have paid dearly, for these rights in the past.

We cannot let unethical or manipulative individuals or groups, undermine our constitutional rights, laws and democratic system, for their own ends.

Things have to change.

LikeLike

The liberals were no different. Putting just on Harper is a significant distortion of the truth. It was the Liberals that brought in the HST in the maritimes not the Cons.

LikeLike

It must be, businesses give Harper donations to favor them. Harper does give the wealthiest corporations in the world, millions of our tax dollars. Harper also gives them huge tax reductions.

Big business certainly paid Campbell big bucks, to fight to keep the HST. Both Harper and Campbell are sociopaths and pathological liars.

There is only one excuse for the atrocious costs in Canada…Harper's greed.

LikeLike

I noted that a parcel receiving service in Point Roberts has had to suspend taking new customers. They've run out of space and capacity to handle more business.

Many Canadians are buying online and having the products shipped to border towns. It can easily be worth doing because American prices on ordinary consumer goods are so much cheaper.

LikeLike

No matter how much misinformation the pro-HST side spun and how many scare tactics they employed, the people of BC saw fit to reject the HST. As it is, I think that the vote was much closer than it should have been, but I guess scare tactics can be effective. Even today we are still hearing how foolish the electorate was from the likes of Michael Campbell, Alisse Mills, Bill Good and a host of the other cheerleaders of the current administration.

I think that it is time that Canadians took stock of what is important to them regarding on how and on what they spend their money. Over the last few years the purchasing power of the Canadian dollar versus its American counterpart has increased by approximately half, give or take. In that time we have seen little impact on prices of imported goods and food, which are pretty much all acquired by the retailers in US funds. Some entities are making out like bandits. The big lie that retailers had old stock to dispose of just doesn't wash. Retailers may have had long-term contracts with their suppliers but they don't pay for them until they take delivery. Thus each new purchase cost them less in Canadian funds. I think that it is time as many of us adopt an austerity program. Buy only those items that you really need and if you do have to satisfy a guilty pleasure or two, buy it from a retailer that is independent rather than a big box store. You may pay a few bucks more for the item, but that may help keep some little guys and gals from losing everything they have invested into their dream business.

LikeLike

@Anonymous 5:04

Don't include David Schreck in that class. He's not getting paid for his opinions by self-interested business groups with billions of dollars at stake.

LikeLike

Perhaps this demonstrates that no matter what the issue, there is an economist willing to offer 'proof' as long as the payment is sufficient.

We arrest people who sell their bodies and reward those who sell their souls.

LikeLike

Canadian businesses got used to charging higher prices and claiming, maybe even believing themselves, that the lower Canadian dollar was entirely responsible.

When the dollar reached parity with the US, one excuse for continued high prices was that there was all this stock in the warehouse purchased when the dollar was lower. What's the excuse now? Why are businesses allowed to have their cake and eat it?

When you can purchase something like a car or snowmobile cheaper in the states than in Canada, even before taxes, and the vehicle is manufactured only in Canada, there's something wrong.

LikeLike