Anonymous reader argued through earlier comments that comparisons between BC Investment Management Corporation and Washington State Investment Board are inappropriate “apples and oranges.” The person attempted to justify huge increases in executive compensation because “Much of the compensation is based on results over the past 4 years.” This question was also posed, “What are the long-term returns of both organizations.”

First, I’ll deal with long term returns. Since 2005, BCiMC averaged 7.2% annual rate of return while WSIB averaged 8.5%. With invested funds amounting to a hundred billion or so, over nine years, the difference in income amounts to roughly $10 billion.

Washington’s investing agency was ranked by Pew Research fourth in the USA for combined funding of its 13 pension programs. Despite WSIB paying about 1/4 of the wage costs of BCiMC, the State Treasurer reported,

“The Washington State Investment Board has averaged over 8 percent annual return on pension funds for the past 20 years – which makes it the number one performer among all public pension investors in the nation.”

No wonder the BCiMC apologist objected to comparisons with our nearest neighbour.

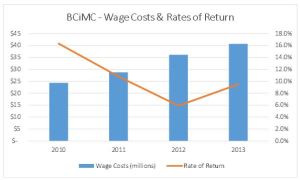

Are salaries established based on results? Apparently not for the most senior executives of BCiMC. In 2010, the five highest paid received $3 million and the rate of return for the year was 16.3%. In 2013, the fortunate five earned $5 million — that same amount paid the top 35 earners at WSIB — and the rate of return in BC was 9.5%. In the two most recent years, while returns averaged 7.7% (against the four year average of 10.6%) the guys in the corner offices had remuneration jump by 50%.

There is another matter of interest in the 2013 annual report of BCiMC. It is a note to the audited financial statements that says,

“Minimum lease payments based on current and new lease agreements in effect as at the periods below are as follows: 2012 $3.9 million; 2013 $30.6 million.” That extraordinary increase is explained by management in this fashion:

“Jawl Properties, our landlord, is developing a mixed-use building that includes office space to accommodate our planned growth. Work on the site adjacent to our existing offices began in 2012.”

Sharp readers will recall that Jawl Properties was involved with BC Ferries when that organization decided it needed higher status premises with better views of the ocean. I wrote Luxurious new offices and enduring gratitude in 2011. It contained this:

“In 2008, the company announced plans to move into 90,000 square feet of a building at 800 Yates Street then under construction by Jawl Properties. B.C. Ferries sold its long time head office building, 53,000 sq.ft. at 1112 Fort Street, to the Jawls for $11 million. By sheer good fortune, the new owners quickly found another tenant: Elections BC.

“According to Note 12 on the BCF 2011 Audited Financials, the lease of new offices in downtown Victoria is for fifteen years, with four renewal options of five years each. The lease agreement includes payment of building operating costs and property taxes but other terms are undisclosed.

“In addition to signing a long term lease before completion, BC Ferries lent the Jawls, developers of the $100 million property, $24.2 for fifteen years, secured by a second mortgage of the property.

“What does BC Ferries get out of this? Certainly, it gets substantially more luxurious executive offices, almost twice the size of those in the old building. They also earn enduring gratitude of the influential Jawl family, people who style themselves as the largest private owners of premium offices and industrial space in the capital. Their properties include Cordova Bay Golf Course, Mattick’s Farm, Sayward Hill and Selkirk Waterfront. They are, of course, substantial contributors to the BC Liberal Party.”

I find it strange that, while BCiMC operates in many cities as a major landlord and has accumulated $18-billion in real estate assets, it made good business sense to become rental tenants of the BC government’s favourite property developer.

As I’ve said repeatedly, BCiMC is an enterprise with massive assets that operates without effective oversight. There are indicators of wrongdoing in the small pieces we can examine but the real opportunity for abuse is hidden from view. That relates to where and with whom these people invest the $100 billion dollars under their control. The directors that could hold management to account are instead porcine feeders at the same trough.

Categories: BC Ferries, BC Investment

Between you, Norm and Bob Mackin, I get sickened more and more each day.

It seems all you can do is report and hope someone, someday, catches on. I just don’t understand why those who should be able to do something don’t. Are they afraid of fires, bricks through the windows, pets or family members disappearing?

Where are the two top guns vying for the NDP leadership, in all of this? They are just too damned quiet for my liking. Where are the fraud investigators, the disgruntled whistle blowers? Are the threats to their safety too great, the hush money too good?

LikeLike

“This will be the last time I will visit your joke of a blog.”

Anonymous, you aren’t going to stop visiting. You can’t stay away, THEY won’t let you and the personal rewards are too great. No, I think you will just move across the street to another free WiFi source and another ip address. The hilarious part is, the more you say the more suspicious we become of the whole rotten gang of thieves you vouch for.

Guaranteed you’ll be back, so cut the na na na na crap.

Hawgwash.

LikeLike

Maybe we should headhunt the head of the Washington State investment fund and pay him half what we currently pay the Top Pig at BCiMC. At least the Washington guy has a history of good return, the BCiMC has a history of supporting Liberal cronyism.

LikeLike

BCIMC's lease obligations rose 850% in the last year, an increase of $27 millions. By your estimates that amount would house the WA State organization for more than 100 years.

Another part that smells is that Jawl Properties is allowed to use public resources to fund their developments. Obviously, BCIMC, like BC Ferries before them, signed a lease agreement for properties that did not exist.

I wonder what other sweetheart deals the BCIMC is doing.

LikeLike

Doubtful. The BC Liberals don't dare take the lid off the can of worms that is BCiMC. There are reason why its senior officers are multi-millionaires, exempt from rules that apply to other crown corporations. They're responsible for placing tens of billions of investments and those choices are made without ethical concerns and with little oversight. Experience throughout the financial system demonstrates that has been a certain recipe for fraud.

LikeLike

Core Review II will agree with you and then the pensions will be shadily outsourced to some BC Liberal connected firm [with 12 month severance checks to all the ex-executives] who will scrape exorbitant fees etc from the funds just before the government proclaims the pensions bankrupt.

LikeLike

Surely there's a type-o in your, otherwise exceptional work. That'd be the Jowl Properties, right?

LikeLike

If Detroit City's fiscal mismanagement is any indication. (and apparently they are just the tip of the “public employee pension” iceberg in the USA). We havent seen anything yet.

Unfortunately, I predict that these BCiMC “managers” will be long gone before the proverbial “feces hits the fan”. Basking in their gold plated senior years, smug in the knowledge that if the world is starving they will still have plenty to eat.

One hopes that cannibalism will be a viable option for dumpster-diving financially ruined pensioners.

If it worked in 1960 China it can certainly work here.

Eat the rich. Exercise and healthy lifestyles. Tenderrrrrrrr

Pass the bbq sauce……

Nonconfidencevote.

LikeLike

Total agreement Norm, Mr Anonymous doesnt seem to want his arguement challenged. I'll take two of your blogs for one of the MSM pablum that poses as “news”.

Has anyone else in the MSM posted the same info on BCiMC as diligently as you?

Has anyone else in the MSM “opened the blinds” on BC Ferries and the Jawl group?

If history repeates itsself.

One wonders how much the obscenely paid executives at BCiMC have contributed to the Liberal election fund over the past 5 years…….

Nonconfidencevote

LikeLike

Just remember,this is my pension you're talking about. This is my deferred wages. The amount I and other pension plan members is based on a formula,that being age + years of service * highest average salary taken over a five year period. I resent that my deferred wages went to an overpriced building in Victoria for a ferry corporation that is swimming in debt because of B C Liberal incompetence.

LikeLike

Guy, if you and I had a gold plated long term lease of a building worth from $50M to $100M, along with $25 million in cash by way of 2nd mortgage proceeds, we'd have no difficulty raising the 1st mortgage to acquire that building without using a single dollar of our own money.

Of course, we not favoured beneficiaries of Victoria's Ministry of Graft and Corruption.

LikeLike

Interesting. Hiding behind anonymity and unable to make convincing arguments, the commenter resorts to attacking the blogger and this “joke of a blog.” I had no problem finding historical results for each of WSIB's last 18 years. As the WA State Treasurer reports,

“…the State Investment Board’s performance was among the top one percent of public pension funds in the country during the past 10 years.”

LikeLike

But, the pensions paid to the bulk of BC's civil servants are not altered by the ROI that BCiMC earns. I might take an interest in management of my pension fund but it won't make a damn bit of difference to my family when the Municipal Pension cheques start arriving.

Maybe that's different for senior staff at BCiMC where pension benefits are substantially more than what most civil servants and quasi-public servants receive.

LikeLike

This will be the last time I will visit your joke of a blog.

Yes the annual reports are available but they lack the information investors need to access the performance. I couldn't find the total return for 2009 but can guess that it was around -24%. No reporting on historical numbers no reporting against INDUSTRY BENCHMARKS. Sorry but that is not good transparency.

Currencies don't affect percentages but they do affect returns. If Canadian dollar appreciates then the value of a foreign investments decreases and it will hurt the return of a Canadian investor (unless they hedged the risk). If the Canadian dollar depreciates, it appreciates and it helps increase the investors return in Canadian dollars. So no need to rethink that one.

As I said yesterday, if you want to learn about pension management, go to someone who has a clue about what they are talking about.

I am retired so I take an interest in whose is managing my pension fund.

LikeLike

Percentages are different depending on the currency? Better rethink that one.

Washington State is much more committed to transparency than British Columbia. Accordingly, annual reports are readily available online dating back to 1982.

Additionally, remuneration of all WSIB's employees are published online. BCiMC reports for the top paid five. We don't know what eight other VPs are paid but you can't pay four of them about a million dollars and pay the others $85,000.

Growth in the total fund depends on contributions by people securing pension rights. That has nothing to do with executive performance.

Beating benchmarks? That a fools' game played in every department of the BC Government. By the way, Northern Insight beat its benchmarks for readership every single month of its existence. Mind you, I created the benchmarks so they're rather easy to beat.

LikeLike

First, it is hard to do direct comparisons because the two entities report in different currencies and for time periods (bcIMC fiscal year ends in March and WSIB ends in June). However I would like to know where you got the return numbers for the Washington State. I have had great difficult finding their historical returns on their web site or in their annual reports. bcIMC, on the other hand, is very transparent as they report current year and historical returns in their annual reports and on their web site. I note bcIMC's returns are reported on a net of costs basis and on a 10-year basis earned an average of 8.2% per annum (as at March 31, 2013).

Second the link between compensation and fund performance is not based on returns per se but on them beating the market benchmark (You might read the section on compensation). For example, last year they beat the market benchmark by 1.7% adding $1.5 billion in value added for their pension clients. So comparing the absolute returns to the exec compensation is meaningless (i.e., they don't get bonuses just because the equity market was strong). By the way, how has washington State done against its benchmarks?

Third, its not a appropriate way of comparing (because of cash flows) but between June 2007 and June June 2013 WSIB portfolio grew $2.1 billion. Between March 2007 and March 2013 bcIMC portfolio grew 16.2 billion.

I guess it breaks down do you want civil servants or professional fund managers managing your pension plans. I'll take the latter any day.

LikeLike

I always wondered where in BC Ferries operational mandate does it specify the Corporation can act as a money lender ? ( BC Ferries lent the Jawls )

Are other BC Corporations in the business of handing out millions to it's landlords ? I remember David Hahn saying this was a good deal for BC Ferries but how can that be verified if part of the terms are not public ?

With respect to the new tenants on Fort street…. I was not surprised… as a matter of fact I actually predicted it when there was a rush by Jawl Properties to renovate. It's not like there was a lot of empty space in the Victoria area ????

Guy in Victoria

LikeLike

Yes the rich and elite of this province continue to scratch each others backs all the while exploiting our tax dollars with the wholehearted support of the BC Liberals. Nothing has changed and the working stiffs continue to vote against their best interests comfortable with the crumbs that fall off the table.

LikeLike

Your first paragraph is yet another example of the LIEberals and their faithful supporters and beneficiaries amusing, yet saddening, attempts to defend the indefensible – but enough of the electorate either buys it or doesn't care.

This comparison reminds me of the difference noticed a few years back in how much easier and faster (with less redaction) it was for a resident of BC to access info via FOI regarding dealings between the jurisdiction of Washington State and BC from the Washington State government compared with butting heads with the BC excuse for information disclosure.

LikeLike

I wonder how many grow-ops they control?

I ask this in all seriousness because in our local, several houses have been purchased by large cops, who then have rented them out as grow-ops. My neighbour was told by one of these new neighbours, who only available periodically; “I hope you have your fire insurance up to date?”

A quick whiff and a frantic call to the local permits and licenses dept.(the police would not touch it with a 10 foot pole!)put an end to it, but how many more houses are being assemble by large corporate structures for illegal purposes.

LikeLike