|

| Not what it seems. |

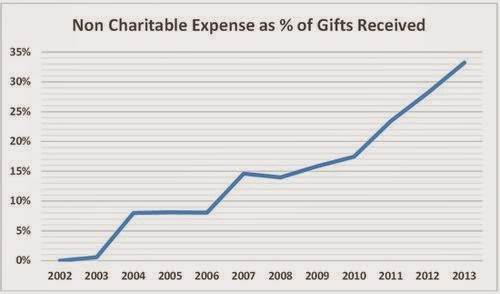

I’ve kept an eye on finances of the CKNW Orphans’ Fund. My attention began after the Corus radio station dropped its long time policy – under Griffiths family ownership – of paying overhead costs of the charity. They were entitled to make the change; they weren’t entitled to remain silent about it. After my first report, CKNW stopped making the claim that it paid all administrative costs for the charity but others, including Pledge Day guests, made it for them on air, without correction.

I was told by a couple of insiders that junior NW staff were surprised by the extent of charges levied against the Orphans Fund when they were being asked to donate time for events. Overheads have cost the charity about $2.5 million since the policy shift.

The numbers shown below are drawn from annual reports to Canada Revenue Agency. Details filed are scant but they certainly leave me with questions. For example, why did advertising expense rise from $803 for 2010 and 2011 to $656,763 for 2012 and 2013? Does the Orphans’ Fund now pay CKNW for air time on Pledge Day or other times? What other payments flow into the accounts of CKNW, Corus Entertainment or associates? What is the nature of $743,706 in professional & consulting fees? Why not make public reports of how the charity spends its money each year? CKNW Orphans’ Fund website identifies only six organizations that received funding in 2013 and 2014 amounting to a total of $133,000. That identifies 4% of charitable payments for the two years.

Clearly, the CKNW Orphans’ Fund has a significant lack of transparency and is accountable only to a small self-perpetuating board that votes for its own replacement.

I forwarded an email to the charity,

“Financial reports to CRA show advertising expense in 2012 and 2013 amounts to $656,762. That leads me to ask if that or a part is paid to CKNW for advertising and/or air time on CKNW Pledge Day?

“If in fact, the Orphans’ Fund pays to sponsor Pledge Day, in whole or in part, is that revealed on air, as would seem to be required under the Canadian Code of Advertising Standards, which prohibits disguised advertising?”

I will soon be posting another story about the clouding of merged corporate and charitable interests. This will examine finances of the Vancouver Sun Fun Run. The newspaper does not hold it out specifically as a charitable operation but they certainly imply that to be an important element. A tipster told me that registration and sponsorship revenues are over $1.5 million and The Sun advises readers that from registration fees,

“$50,000 is donated annually to The Vancouver Sun Raise-a-Reader campaign and $80,000 is given in support of BC’s amateur athletes via the Achilles Track Society and The Vancouver Sun International Jerome Track Classic.”

The following information is drawn from CKNW Orphans’ Fund annual reports to CRA:

At Christmas, I will listen to pledge day to see if NW's guests read from a different script.

Instead of “Every penny goes to the kids,” we should hear.

“About 60 cents of every dollar goes to the kids – or less if the organizations that get Orphans' Fund money also use part of it for their overhead costs.”

LikeLike

Ms. Schaeffers, you refer at several points in your post to inaccuracies and a need to correct statements that have been made on this blog. When I read the blog, I see a financial summary derived from information you provided to the CRA, and a number of legitimate questions asked about the summary. Where are the inaccuracies you reference and who is responsible for them?

Your statement that the blog omits the fact that the revenues have grown over $825,000 is itself inaccurate. The figures are clearly presented in the summary.

Your statement that the CRA lumps a lot of expenses together and aren’t really what the public would expect, and your use of quotation marks to describe elements of the financial summary are very good examples of the need for your organization to publish a detailed summary for each fiscal year of operation. There would then be no need for anyone to search CRA records and attempt to decipher where the money went. In short, any misconception or confusion is caused by your lack of up-front disclosure, not by those attempting to discern how you operate with donated money.

I don’t think anyone believes that the CKNW Orphan’s Fund is not a worthwhile charity. Your obvious pride in its work is evident and commendable, as is the charity. But consider this: CKNW’s advertised raison d’être is the business of asking questions and holding entities such as governments and corporations to account. There are (or at least CKNW professes there aren’t) any sacred cows. That should include the Orphan’s Fund.

I’m left with several questions after your response. Hopefully the detailed financial report you will now develop for the public each year will answer them.

LikeLike

Charity should be an act with a degree of humility, not an opportunity to polish your own apple. Many larger corporations have staff request donations and in a self aggrandizing manner, give the proceeds to a favoured charity and then tell the world what wonderful people they are.

LikeLike

Glad to hear from the charity. I would have expected to hear that Corus would have charged for the advertising dollars in favour of the charity, and made a donation in favour of the charity equal to the advertising spend. That's the usual way it's done to provide transparency for CRA, and that's doubtless how the Griffiths family used to do it too.

To hear that “Significant daily radio exposure at no cost to the charity” is provided makes me want to believe in the corporate tooth fairy again. It means Corus gets no receipt for the work it does.

LikeLike

First we would like to take this opportunity to correct some of the inaccuracies in your blog and, given your interest in the CKNW Orphans’ Fund, also provide you with information on both the individual grants to children and the organizational grants we provided in 2013.

The CKNW Orphans’ Fund is one of the largest sources of individual grant funding in the province of BC. Our admin costs are generally 9-12%. We have two full time staff – myself and our grants administrator and a part-time finance coordinator. We also employ an accountant on a casual contract basis.

One thing you omitted from your blog is the fact that CKNW Orphans’ Fund fundraising revenues have grown over $825,000 since 2011, giving us the ability to help thousands more vulnerable children with special needs in BC.

As noted, we wish to correct the record regarding a number of statements in your blog as follows:

1. Advertising expenses: the CRA return lumps a lot of expenses together under “advertising” even though they aren’t really what the public would consider advertising.

o In 2013, our “advertising costs” based on the Charity Information Return (CRA) were $373,642 which includes the following:

– Over $250,000 to pay for 70,000 Pink Shirt Day Tshirts which are then sold at London Drugs and online. 100% of the net sales from the Pink Shirt Day Tshirts are distributed to anti-bullying programs in BC. In 2013, our net proceeds were $275,000 (above and beyond the cost of the shirts) and all of this money was distributed. Our current website reflects our 2014 grant recipients (PinkShirtDay.ca)

– $6,140 in postage as we send a mailout once a year to over 9000 donors. This also includes mailing costs for sending tax receipts.

– $2,400 in printing supplies and $2,400 on advertising – ie. Banners for pledge day and website development.

– Over $40,000 in expenses for our annual Picnic at Playland when we host over 3500 special needs children at Playland. We pay for all the costs of this day including bus transportation, meals and the cost of rides.

The CKNW Orphans’ Fund DOES NOT pay for airtime on CKNW radio station. Corus Entertainment provides:

– An annual financial contribution

– Free office space and free office supplies for our 2.5 staff so the charity does not have to pay rent. This is an incredible advantage, particularly given the high cost of rent in the downtown Vancouver market and allows us to have such a low administrative cost ratio.

– Significant daily radio exposure at no cost to the charity – we are provided with radio spots each day to talk about the work we are doing and the children we are helping.

– Corus Radio staff donate their time to help the cause, particularly on Pledge Day, Pink Shirt Day, Picnic at Playland and other times throughout the year.

2. Professional and consulting fees: In 2013, our total based on the Charity Information Return (CRA) was $73,472 which included:

– $41,178 for a professional designated accountant and other ad hoc consultants including some marketing costs.

– $7,000 for professional audit fees (which most charitable organizations are obligated to do).

– $3,700 in honourariums for us to employ casual students hoping to start a career in the non-profit world.

– $22,000 in banking and investment management fees.

3. Grants: In 2013, we provided 387 individual grants totaling $867,720.43 to individual families:

For organizational grants we funded over 32 organizations for a total of $653,467.50 granted in Fiscal 2013. These organizations are running programs that directly benefit children with special needs and are grassroots charities filling a community need.

We appreciate the opportunity to respond to your post. We are incredibly proud of the work we do in the community. Our small team works very hard to help special needs children in BC and we are passionate about the children we help.

We hope these corrections can help you understand more about the Fund and the positive work we are doing.

Warmest regards,

Jen Schaeffers

Executive Director

CKNW Orphans' Fund

LikeLike

Evil Eye, if you ran on a platform of 5% in “administrative costs only” you'd get my vote. It certainly ought not to be higher than 10%

WE have harper and his herd auditing charities to ensure they don't send a nickel more than the are supposed to on advocacy work, now let the Cons implement a law regarding “expenses”.

The “costs” claimed by so many “charities” has led me to conclude most of these big “charities” are simply “big business”. its not that I don't think people who work for charities ought not to be paid a living wage, etc, but some of these administrators are paid more than government workers and we do hear ever so much about how “over paid” they are.

The amount of money classified as :”expenses” is one of the reasons I no longer support any “big” charities. I have found organizations such as my local Rotaries spend a whole lot less on “expenses” and do a whole lot more work. If you're concerned about a specific cause, its much easier to donate directly rather than through some of these “big business” organizations.

LikeLike

This is a true story.

My father was a veteran who saw active service in the North Atlantic. He was not a strong Legion member but maintained a membership with the local branch and attended Nov.11 ceremonies religiously. In the late 60's he became more active and ended up as president and found to his horror that the branch was broke, end of story.

It was very bad as those loyal members drank most of the money away and emptied the “Poppy Fund” for their own personal benefit. The bar staff were running riot and selling more of their booze than the Legion's!

My dad and a few other loyal members, after a great deal of time and effort, over 5 years, put the branch back on its feet again and saved the branch from the embarrassment of bankruptcy. During this period my father and the “clean-up” crew were threatened with violence, which “Central command” failed to address and many an evening was spent dealing with Legion business. Also during this period, my dad and the crew revived the local ;11th services to a point where hundreds of people attended and with increasing profits from a very tight ship revived the Christmas Hamper program (over 100 given out at the end of my dad's tenure) and restored the Poppy fund and ensured monies went to veterans and not someones back pocket.

In the 90's, my father suffered from dementia and I inquired if here was any programs to help my dad and my mom during the my dad's difficult stage in life.

On the advice of other Legion members (the “crew”) I found that there were several Legion sponsored services which my father could avail himself of and had a meeting with the President of the branch. Short meeting as I was told in no uncertain terms that my father would not be eligible for any legion program (yet the local sponsored a soft ball and a fast ball baseball team, etc.. I inquired as to the “Poppy Fund” which is specifically there to help veterns, which his answer still burns in me; “Just because your father served in a f****** war doesn't make him special you know.”

I avoid the Legion and I do not donate on the 11th. There are a very few real veterans now and most of the membership is made up of the “no head gear crowd”, so I feel it is time for this dishonorable organization fade away from memory as WW 2 is fading away from memory as well. I am tired of subsidizing “old-soaks”.

LikeLike

Should that not be, CKNW's, Chorus', X Consulting's, and Orphans' Fund?

LikeLike

Mooching orphans!

LikeLike

You might want to squeeze some info out of Blue Shore Financial sponsor for Vancouver Sun Run

North Vancouver, B.C., August 18, 2014 – BlueShore Financial is pleased to announce it will be presenting sponsor of The Vancouver Sun Run again in 2015. The iconic community event will mark its 31st year on April 19, 2015.

LikeLike

Charities are a massive rip-off, pure and simple and with little regulations with their operations, will continue to rip off the good people who donate.

The “Eye” has been involved with several charities and found that they are money fountains for those who operate them. The dinner “wrap up” tends to be fraught with over eating and drinking and where the final bill (paid by the charity) would be in the thousands for 6 to 8 people! I refuse to attend.

Another charitable event, I was not associated with the charity but was a coach providing student man power for a donation to the sports team (bring the kids to work and we will donate to your team) and it was an eyeopener. Free hot chocolate and dogs were given to the boys and girls, which I had no complaint, but for the members of the said charity, a booze room was set up where generous libations were provided. The “Eye” isn't much of a drinker, but I do know what $100 a bottle scotch is, etc., etc. The “Eye” , two fathers helping me,and the kids were the only ones sober by 11 am!

National charities are even worse, especially those who ramp up operations in November!!!!

To stop this bleeding of charitable donations, I believe a simple law be enacted, no more than %5 of donated income be allowed to be used to pay overheads for charities. Maybe not the best thing to do, but at least it is a set of goalposts that the public will know that at least 95% of their donation will actually be for charitable use!

LikeLike