- “This year, our audit opinion on the Summary Financial Statements contains two

qualifications, or areas for concern. One involves the way that government records

certain revenues in future years, rather than when received and used. The other

qualification relates to prior years for how a Crown Corporation was classified.”

These issues are technical but generally accepted accounting principles (GAAP) provide a consistent way of presenting financial positions of organizations at particular times, as well as the results of operations for the periods reported. Without this framework, stakeholders are less able to determine how money is managed. The Wall Street Journal referred to GAAP as an idea that is “so simple yet so radical.”

Governments, because they make rules, don’t feel compelled always to follow rules. This was noted by Alana James, a BC health ministry lawyer who wrote about the attitude she perceived among colleagues,

“…it’s unfortunate that we don’t follow the law but that we plan on changing the

legislation at some point so that we will.”

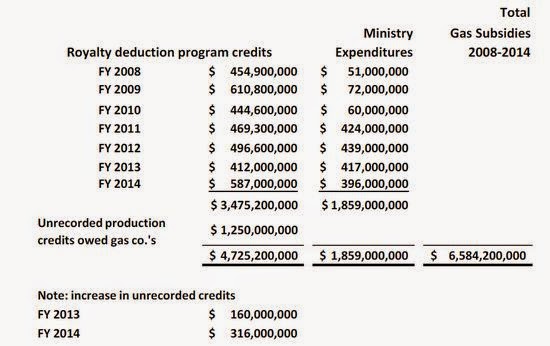

The Auditor General draws attention to information already known by Northern Insight readers. She reports that, in fiscal year 2014, oil and gas companies deducted $568 million from royalties that would otherwise have been payable and that a further $1.25 billion in credits remain available for deductions in the future. That unrecorded liability increased by $316 million from 2013 so, in one year, oil and gas extractors gained the current and future benefit of $903 million of incentives, a subsidy that touches $1.3 billion if ministry expenditures are included.

Ms. Bellringer takes a direct shot at public-private partnerships that Liberals claimed would save taxpayer money,

- “it is interesting to note that while government’s weighted average cost of

borrowing is approximately 4%, on the $2.3 billion that government borrowed through

public private partnerships this is 7.5%.

Goodbye $80,500,000 a year.

BC Ferries, while not paying interest as high as P3 operations, paid an average of 5.5% on its $1.346 billion in term debt. The premium over government borrowing rates burdened the ferry company with an extra $20.2 million interest in FY 2014. Multiply that over the 11-year life of the “private” ferry corporation and you’re talking significant money drawn from the pockets of coastal commuters.

The Auditor-General draws attention to gilding that made 2014 financials deceptively attractive,

- “When assessing financial performance, it is important to look for, and understand,

the impact of one-off events, such as the sale of government owned land or buildings.

Last year, government earned $601 million from the sale of assets: $311 million from

government’s program to release surplus assets, such as two former gravel pits in

Surrey and a surplus parcel of land in Kamloops; and, close to $290 million from the

Little Mountain property in Vancouver. …Although only a small percentage of total

revenues, the gain is a significant part of the bottom line for the year, which was

reported as a $353 million surplus in the 2013/14 Summary Financial Statements.”

There are numerous other items worthy of comment in the auditor’s report, including BC Hydro’s use of expense deferrals. These inflated the utility’s equity and allowed government to scoop extra funds and enjoy more attractive headlines when deficits or surpluses are reported. I will be writing about this separately but will note a comparison of deferrals with an eastern utility that owns assets three times the value of the power company in this province:

- BC Hydro $4.7 billion Hydro-Québec $8 million

By the way, I will be on CFAX1070 Monday at 2pm to talk with Ian Jessop about the Auditor-General’s report.

Categories: Auditor General, BC Ferries, BC Hydro

“the propaganda department”?

BC Liberal policy brought to Vancouver city hall.?

“control the message”?

http://www.theprovince.com/news/Political+rivals+take+Vision+Vancouver+stonewalling+with/10336215/story.html

LikeLike

Story covered in Vanc Sun:

http://www.vancouversun.com/story_print.html?id=10339925&sponsor=

LikeLike

Yes thanks for sure Norm, your articles are always

welcome in this home amid the crap the mainstream media calls news these days!

LikeLike

Guy: would that it was only to “proclaim a few jobs” and not to affect those damned three- Ps,

Plunder, Pillage and Parasitize.

LikeLike

I understand the irony of your statement but even Christy would acknowledge that Blackcomb Aviation is doing very well and will continue to the favoured carrier whenever a photo op presents itself.

The Auditor General's office cost taxpayers $15.3 million in FY 2014, underspending its budget by $700K. In addition, taxpayers paid many millions more for departmental accountants involved in internal auditing.

As a proportion of total spending, the cost is minuscule, considering the importance of the tasks. I think John Doyle did an effective job – which is why Liberals wanted him gone – and that his departure led to the Liberals gaining a pass on important issues, like the BC Rail plea inducements.

Ms. Bellringer's annual report is a good start although IMO, she pedals softly. Nevertheless, her work is a step up from that of Acting AG Russ Jones, who somehow dropped the material issue of unrecorded gas subsidy credits when he signed the July 8, 2014 Independent Auditor's Report issued with 2014 public accounts.

LikeLike

If the AG, the position not the individual, is so inconsequential, why have it. The AG pulls in over $30,000 a month. Add all the related expenses of staff, research, offices etc. and I'm guessing the monthly payments to that enterprise are well in excess of a hundred grand. Would that money not be better spent on Blackcomb Aviation so Cee Cee could get around the province more?

Hawgwash

LikeLike

Accountants see a difference between operations and capital transactions.

If government takes in $50 billion in tax revenue and spends $50 billion on services and consumables, they have no deficit, no surplus and no change in capital asset base.

If that same government borrows $10 billion to build a bridge across Howe Sound, they still have no deficit in operating accounts. They have $10 billion more in debt but also have $10 billion more in assets. That may be careless, it may be wise, depending on how much the public needs the bridge. If the bridge was truly needed and provides demonstrable benefit, it was probably a good choice. If it were merely a make work project to reward friends or a foreign based contractor like Kiewit, the choice would be the opposite.

In simple terms, we might be spending most of our employment income on the costs of daily living but we then borrow to buy a house. Our debt has risen, but the cost of servicing the debt might be equivalent, more or less, to what we previously paid in rent. Yes, we are more in debt but we have an offsetting asset. If we acted reasonably, we're probably better off in the long run.

LikeLike

Food bank follies – and the lineup keeps getting longer.?

Corporate profit public debt.?

I can clearly see 20/20 Bc Debt trending to 100 billion dollars around 2020

LikeLike

Thank you. Your kindness is much appreciated.

LikeLike

To qualify opinions, auditors have determined that issues are material and worth consideration although they may not completely misrepresent the factual financial position. If they did, auditors would issue disclaimers or adverse opinions.

In the end, the financial statements belong to the reporting party, not the auditor but, normally, a clean audit report is seen as a necessity by most organizations. When I was in business, it would have been inconceivable to take anything but a clean auditor's report to the bank or the shareholders. To that end clients and auditors spend much time discussing the issues. However, the will to fight a client decreases when the accounting firm is submitting large invoices and getting paid.

However, as I point out in the article, governments often believe that they can do pretty much whatever they choose. For that course, they need platoons of spin masters and a cooperative press because ultimately, public opinion is critical. Liberals and friends pay large stacks of government funds to ensure they control the public dialogue. (It is one of the reasons that I've made an issue about pundits collecting fees from groups they cover.)

The previous Auditor General John Doyle learned the price of being assertive and staying independent of politicians. He was unceremoniously dumped and then subjected to a smear campaign orchestrated by the Liberals. He was replaced by a much friendlier Acting Auditor General who I hear wanted the job permanently but was not acceptable to non-government members of the public accounts committee.

LikeLike

Hi Norm

I have been reading your blog for years and just wanted to thankyou for all you do. Keep up the great work. We all owe you a debt of gratitude.

R Leighton

LikeLike

I share Hawgwash's confusion. Very salient questions! I have another: If we have a “Balanced Budget” (courtesy Clark, Colman et al) How come the Provincial Debt keeps 'inching up', at astroidal speed?

If/when I balance MY budget, MY debt doesn't disappear, but it doesn't rise astronomically. In fact it stabilizes. Am I missing some GAAP?

LikeLike

BC breach of fudiciary duty.?

http://www.lawyersweekly.ca/index.php?section=article&articleid=1033

Private ipp power 14 cents per kWh

Site C 100 dollars per MWH

Both way over market price

Overpaying interest on BC loans also.

LikeLike

Norm;

Please explain to us commoners how successive Auditors General can point out serious flaws in the Government practices and shoddy (shady?) accounting without anything ever coming of it. I assume that the ethics of the profession require the AG to report when GAAP are not followed but is there no one who can force the issue? You and others have been reporting this shell game for years, yet the status quo remains intact.

Is the AG’s position so weak, it is seen as token and a small irritant the government has to tolerate?

Hawgwash.

LikeLike

It's interesting Norm that a lot of this information is something you have already written about, I'm not the only one to see where you were going with these articles and it's a sad example of a government that will give away our resources so they can proclaim a few jobs have been created. And the media never questions how much will these jobs cost taxpayers.

On occasion I have quoted your research on other media sites only to read replies that “why would anyone believe a blogger”.

Maybe from now on I will refer to you as the advisor to the Auditor General.

Guy in Victoria

LikeLike

Ever thought about getting a job as the Auditor-General, Norm? I'd be all for that…..

LikeLike

Gas subsidy info written here and in AG report. Has it been written about by Palmer, Baldrey, Fletcher, Leyne and press gallery buddies?

LikeLike