An update of our June report on the results of monthly petroleum and natural gas rights sales.

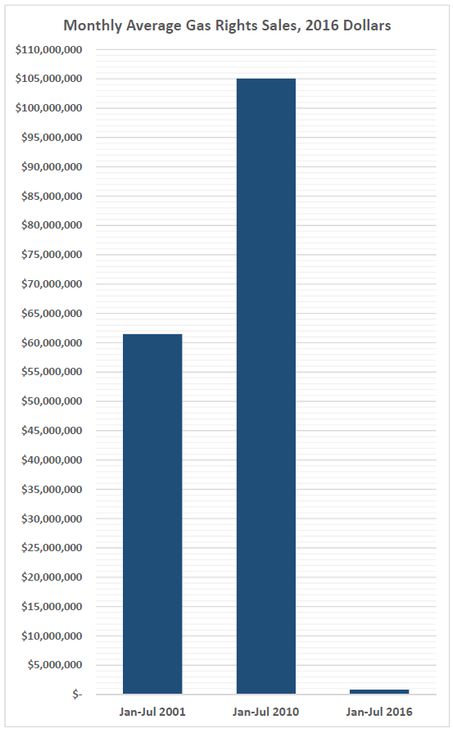

We have July 13 results of the monthly Crown Petroleum and Natural Gas Rights Public Rights Tender. Revenues were $510,661 so proceeds for the calendar year-to-date are less than $5 million. In the year before Christy Clark became Premier, the same seven months brought in $735 million. (Amounts in 2016 dollars)

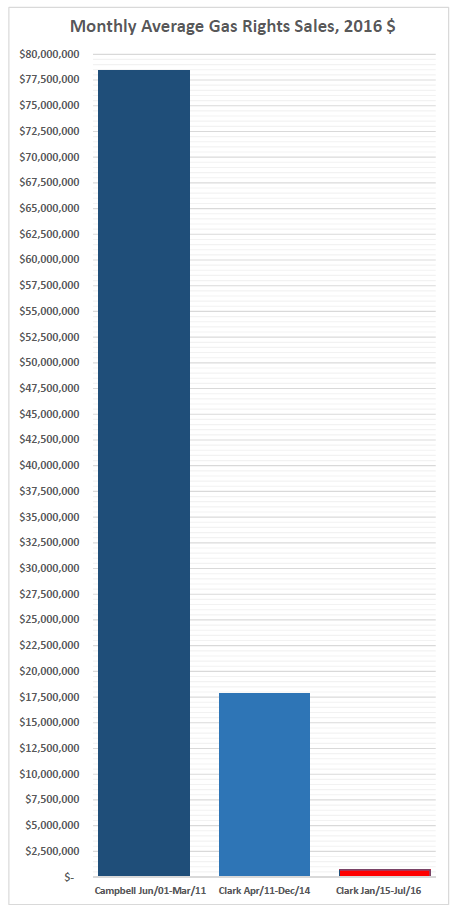

In 64 months of her Premiership, Christy Clark’s government brought in $1 billion from gas and petroleum rights sales. In the last 64 months of his leadership, Gordon Campbell’s brought in $7 billion. If we rank revenues in the first seven months of 2014, 2015 and 2016 against the last 20 years, they rank 18th, 19th and 20th.

This is not a statistic you will see repeated in Postmedia newspapers. A consequence of news media entering partnerships with industry groups is a restriction of what news can be reported. However, those of us not funded by industry can report whatever facts are there to be reported. As usual, simple charts illustrate the information:

Keep in mind that rights sales are only part of the potential revenue streams from oil and gas. Another involves royalties, payments based on profitability of gas producers. In 2001, those amounted to $1.63 billion in current dollars. In the last four years, they have averaged less that 10% of that amount, despite huge increases in production volumes.

When Gordon Campbell announced his resignation in 2010, the underlying reasons were never clearly reported. Bad approval ratings played a part but Campbell was pushed strongly toward the door by natural resource producers who were jealous of sweetheart deals made for private producers of electricity. Mining and gas companies wanted to end large payments into the provincial treasury. Campbell was not sufficiently responsive to their demands.

Special interests knew their treatment would improve under Christy Clark and the numbers prove they were correct.

Categories: Methane Gas

There actually is a large underground gas storage facility near mile 115 of the Alaska Highway north of Fort ST John. Recently purchased by Fortis from Chevron. Gas is compressed into a sealed formation during low demand in the summer and reclaimed during high demand in the winter. Costs money to cover the inventory, plant and operation. Helps to keep the average price low I think. Compare your gas bill and it’s relative steadiness to gasoline pricing that can be manipulated simply by not sending bulk trucks to service stAtions thereby creating a shortage and resulting price spikes.

LikeLiked by 1 person

CFVUA, thanks for that info. I didn’t think Tilbury would be sending gas back out to the Fraser Valley, so wondered why we in Chilliwack would be getting “storage” fees if we were drawing off the main line.

LikeLiked by 1 person

Yes. Since the gas you burn is most likely sourced in NEBC some of it may have passed through the Aitken Creek storage facility. A handy feature to have in times of high demand to level pricing and allow constant, conservation level productionof wells that, if shut in may not come back as strong or at all.

Storage is best located nearer demand in the event of a gas pipeline failure, which in the history of the NEBC to lower mainland system in BC has not happened. The Aliso Canyon facility was perfect except for the people that didn’t spend the few dollars to properly abandon the old oil wells that were drained, creating the empty formation in the first place. Unfortunate, as it could have been a very safe facility as is the one we have in BC.

LikeLiked by 1 person

G. Barry Stewart says, “I can imagine, without the prospect of LNG sales, gas drillers have probably tapped into all the wells they need for a while…”

That would seem to be valid imagining. But as Norm has informed us previously, the amounts listed for each fiscal year do not represent the actual amount bid for that year. The bid amount is reported as income spread out over subsequent years. So at the time Christy Clark and the BC Liberals were promising hundreds of billions flowing in from booming natural gas sales, they had to know that the industry had been in full retraction mode for several years. They had the numbers.

It appears then, that Christy Clark and the BC Liberals have some explaining to do about those promises. Were they borne of total incompetence? Or deliberate lies?

It doesn’t help that people like Mike Smyth and Vaughn Palmer work for corporate interests that are business partners with corporate interests that contribute heavily to the election machine of Christy Clark and the BC Liberals. Because even if Mike or Vaughn took the time to inform themselves sufficiently to know what questions to ask (by reading Norm for example), the embarrassing answers would never be published.

John Horgan must start asking these and many other questions in very loud and very innovative ways. And he must develop the situational awareness necessary to know his enemies; especially the MSM in BC.

LikeLiked by 1 person

Ya but we got the 100 million dollar prosperity fund right? lol

LikeLiked by 1 person

How’d you like to inherit this mess next May? Not me! Its bad enough when you have all the shills and shysters on your side. Can you imagine what it would be like when they’re all agin you?

LikeLiked by 1 person

A money man acting for natural resource industries was waiting in the Premier’s office as her “transition advisor” when Christy slithered in. Guess he never left after pushing Campbell hard toward the door. The government hadn’t changed, and Gwyn Morgan had no experience in government in any case, so one could be forgiven for asking whether the “transition” involved a move from public to private treasuries.

LikeLike

Just to be clear… gas rights sales would be for new drilling. Yes?

Then there’s revenue from the sale of natural gas to homes and businesses, correct? I don’t know the exact number of gas-burning homes and businesses — but I think one million customers (in BC) would be in the ballpark. Then there are the out-of-province and USA sales.

I can imagine, without the prospect of LNG sales, gas drillers have probably tapped into all the wells they need for a while — but we SHOULD be making substantial income from the sale of the product to customers. If we’re just giving it away, my gas bill should be a lot cheaper than it is.

LikeLiked by 1 person

The province offers up rights to explore for fossil fuels on various parcels of land each month. During Clark’s tenure, an average of 13,471 hectares have been offered and bids accepted on an average of 10,418 ha.

According to a government website, agreements are for three to ten years and can be renewed or extended. However, recent tenders are almost entirely 3 year terms. Rights are provided to specific areas and may include rights to all depths, or may be restricted to certain geological formations. We cannot know the exact terms of any one arrangement or can we know if it is renewed without being put out to tender again.

Purchasing rights to explore or drill is different than paying royalties on actual production. Royalties are tied to profitability and amounts that might have been paid can be reduced by subsidies government provides to assist with drilling costs. Those credits are not recorded on government books as they are earned by gas companies and information about credits is barely reported; government and industry prefer to keep quiet about details. Within the next two weeks, BC’s audited financial statements may be released and detail of the future liability for credits may be disclosed in footnotes. The information has been in annual financial statements for only the last few years after Auditor General Doyle made an issue of them being kept secret. The new AG dropped Doyle’s concerns; I hope she doesn’t stop reporting the amounts owed.

The whole process is opaque to citizens. We can though see part of the information but government has little interest in full disclosure.

BTW, government gets resource revenues from rights and royalties and those amounts are determined when gas enters the distribution system. The sellers of gas within BC collect carbon tax and a “clean energy levy” and remit that to the province (plus GST to the feds) that is paid by end consumers and is not counted as natural resources revenue. Those consumer taxes don’t apply to gas shipped out of province.

BTW, check your gas bill. On mine, the cost of gas was less than 1/4 of the total charges.

LikeLiked by 1 person

Thanks for that, Norm.

I see that my March bill was $46.17. “Cost of gas” was $6.70. 14.5% of the total bill was for the actual product.

Almost as steep a mark-up as bottled water!

LikeLiked by 1 person

Don’t you just love being charged for “storage” when you are not using gas.

LikeLiked by 1 person

I’m suspecting “storage” is the cost of the Tilbury plant, to compress to LNG (rather than storing in big underground tanks as in California), then regasify when a big demand hits.

Norway’s Snohvit LNG boasts “The energy efficiency of the liquefaction facility is 70%, which is the best yet achieved in any plant of this kind across the world…” Someone has to cover the 30+% loss to Hydro used at Tilbury.

LikeLiked by 1 person

Ah, patience, sir. Christy and Rich, trained as they are for just such a crisis, have it all in hand. They are diligently hawking a product we don’t yet make, to a country that is up to its ears in it in competition with countries much closer than we are with a cheaper product. Now, if you’d flunked out of three first class universities, including the Sorbonne, or learned how to nail drunks in a roadblock perhaps you could see the keen business acumen of our Premier and Deputy Premier more clearly. A little more respect for your betters, sir.

>

LikeLiked by 1 person