Comparing BC Hydro reports of calendar year 2015 to CY 2007, we learn that sales to residential, commercial and industrial consumers declined by 1,827 GWh to 49,272 GWh. Yet purchases from independent power producers (IPPs) rose by 114% or 7,690 GWh.

Comparing BC Hydro reports of calendar year 2015 to CY 2007, we learn that sales to residential, commercial and industrial consumers declined by 1,827 GWh to 49,272 GWh. Yet purchases from independent power producers (IPPs) rose by 114% or 7,690 GWh.

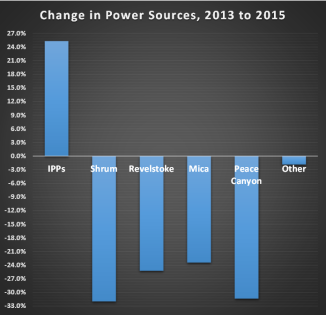

In 2015, BC Hydro produced 6,600 GWh less at its own hydro sites than it produced at the same facilities, on average, 2006-2008. If the utility buys more private power and sells less to its consumers, since there is no profitable export market, it must turn off internal supply. Simple economics.

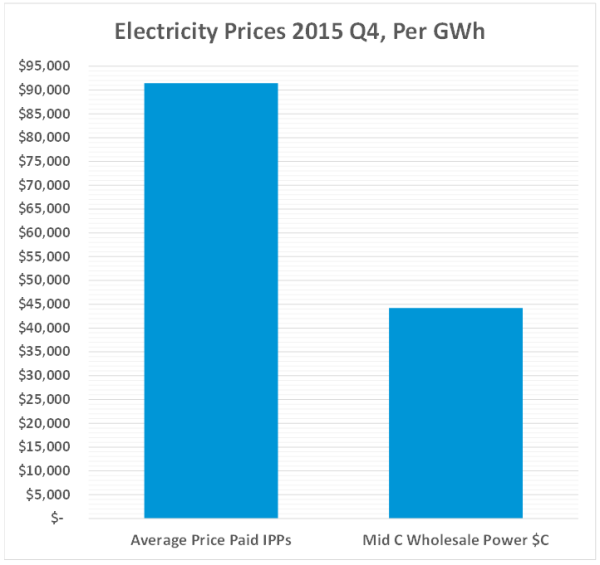

Comparing CY 2007 to CY 2015, the amount paid IPPs increased $762 million or 167%. According to BC Hydro, the per gigawatt hour price paid IPPs in the quarter ended December 2015 was $91,422. In the same period, the average MidC wholesale price was $44,212 Canadian, well under half the amount paid IPPs in British Columbia. In addition, BC Hydro paid to extend transmission facilities to bring private power all over the province into its system. Widely distributed power sources with less than optimum line efficiencies result in transmission losses that drive up the effective cost of power.

The status quo benefits a relative handful of people in BC and investors elsewhere – most IPPs are owned outside BC – but most people in this province pay the cost.

Edison Foundation’s Institute for Electric Efficiency estimated the cost of saving electricity is 3.5¢ per KWh. That is far below the marginal cost of new power and should be the focal point of provincial policy. Instead, troubled with surplus power, BC Hydro rolled back conservation and demand management incentives.

Additional private power is unneeded, yet more IPP deals are coming on line. Electricity consumers in BC will not use SiteC power and there is no certainty of it being needed in 10 to 20 years. Breakthrough alternative technologies are more likely.

Utility scale solar generators are already capable of producing power at about half the cost of Site C and new solar cells containing earth-abundant minerals are evolving. Technologies such as the flagship project of Californian fim SolarReserve promise higher efficiencies, lower cost and flexibility in application.

Categories: BC Hydro, Independent Power Producers (IPP)

An amazing statement in the responses to Palmer’s article on Site C:

“If BC Hydro has a temporary surplus of power due to Site C they will be able to sell it at a premium.”

No, it isn’t Christy Clark talking — but I’m pretty confident the man is a CC supporter.

I wondered to him if we could use the same thinking with our surplus of natural gas. No response so far…

http://vancouversun.com/opinion/columnists/vaughn-palmer-site-c-development-remains-dam-risky

LikeLike

Norm:according to your figures, did we not in 2015 strand more generating capacity (not produce 6400 GWh of electricity) which is more than the projected output ofSsite C which is 4600 GWh per year?

LikeLike

The amounts produced by the utility’s hydro facilities and availability of power to consumers varies from year to year based on water flows, conditions of generating facilities and efficiencies of distribution.

BC Hydro has spent more than $10 billion dollars in recent years (not including Site C) upgrading generating equipment and transmission systems. One would expect to see production efficiency resulting from these upgrades yet the value of assets employed to produce a gigawatt of power has doubled since 2009. This is financial inefficiency that would worry any accountant.

Part of that arises from buying electricity from more than 100 private power sites all over the province. BC Hydro not only pays the producers more than double market value but it spends big dollars for collection systems. These extensive line runs tend to be less efficient and that costs large sums, for both capital costs and transmission losses.

One other reality is that IPPs produce the most power when the public system needs it the least.

Damien Gillis of The Common Sense Canadian wrote recently of:

LikeLike

Continued signings of obscenely overpriced IPP contracts constitutes another Ms. Christy scandal worthy of her removal from office no later than May 9th, 2017. Just one of many. Her legacy is assured. We can no longer afford this government. Clark’s twenty-five thousand dollar, one on one luncheons are a testament to her government’s corruption. Bring back democracy.

LikeLike