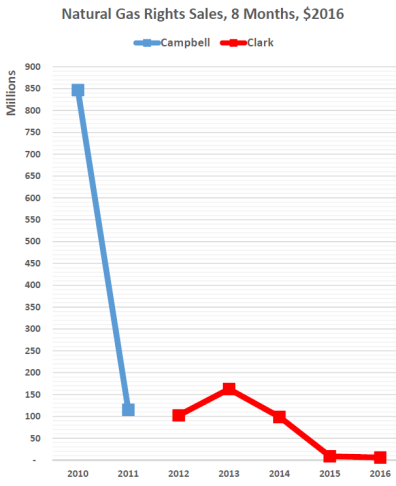

The Crown Petroleum and Natural Gas Rights Public Tender brought in $950,121 this week, raising the 2016 eight month total to $5.8 million. 2015 and 2016 are the two worst years among the last 20.

The Crown Petroleum and Natural Gas Rights Public Tender brought in $950,121 this week, raising the 2016 eight month total to $5.8 million. 2015 and 2016 are the two worst years among the last 20.

It’s another bad result for a Premier who ran the last election on a claim that large natural gas revenues would result in a debt-free, sales-tax-free BC.

B.C.’s liquefied natural gas boom to fuel $100 billion Prosperity Fund, Canadian Press, February 13, 2014:

The government’s throne speech delivered Tuesday announced a new B.C. Prosperity Fund that could accumulate between $100 billion and $260 billion in revenues from LNG royalties and business taxes, enough to wipe out the province’s current debt of $56 billion and eliminate the need for a provincial sales tax.

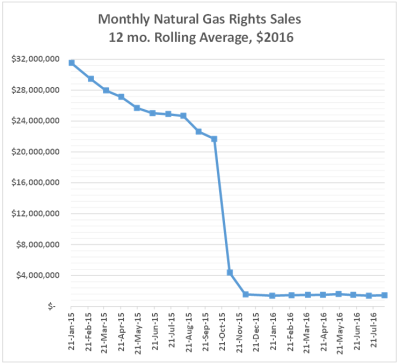

Reporting actual rights sales results, these charts are free of spin:

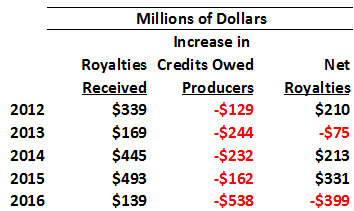

Rights sales aren’t the worst part of the BC natural gas story. The other potential revenue source is from payment of royalties on produced gas. Royalties are not calculated as a share of revenues received from gas deliveries; they are based on net values calculated after various deductions and further reduced by government contributions to production costs.

These subsidies are deducted from calculated royalties but the government share is already so low that producers can’t deduct all of the credits earned. That has resulted in a steady growth of the amounts owed producers. Under Premier Clark, the liability has grown from $650 million to about $2 billion.

Because accounting for the production credits owed would erase claimed Liberal surpluses, government chooses not to record the amount owed. They’re allowed to build this poison pill for their successor because, unlike private businesses, governments can make their own accounting rules.

When we include credits owed, the royalty income looks much different. Accountants that I know believe this is a more accurate representation of natural gas royalties:

If you are waiting for a debt free province or elimination of sales taxes, you’d best be very, very patient.

Categories: Methane Gas

I would question whether the $5-6 billion actually translated into actual effort on the ground to prove up natural gas resources when most of that was spent buying up companies and properties to acquire ownership for the long term. In other words, if rights to a property are sold off, that simply means a change in ownership… think Enca’s sale of a percentage of its natural gas assets to Mitsubishi.

LikeLike

I believe the $20 Billion included the construction of Site C. Perhaps a little over its ‘estimated’ cost but closer to its final cost?

LikeLike

No John, he was talking about investment coming into BC on projects related to LNG. No outside investment in that turkey. The ($ blank cheque north of $10 billion) Site C “investment” is being made on behalf of and will be repaid on the backs of our grandchildren and their children. They won’t be impressed.

LikeLike

The ever-gaseuous Rich Coleman was interviewed by CKNW’s Jon McComb about LNG and the recorded interview aired yesterday. Strangely, Mr. Coleman didn’t mention IOUs for production credits. He did however tell us there has been $20 billion invested in BC by natural gas concerns in the last four years, $5-6 billion of that in “proving up” natural gas reserves. He wasn’t asked for details, but did assure us that billions of dollars in taxes and royalties and hundreds of thousands of LNG jobs would be coming to BC “within his lifetime”.

Later, Mike Smyth repeated the $20 billion claim without once wondering where that activity was, how many jobs it produced, or how much of that $20 billion made its way to the provincial treasury. Surely there should be some clear and demonstrable monetary benefit to the citizens of BC on $20 billion in economic activity, and the government would be eager to show us. No such show and tell has appeared, and Mike Smyth isn’t wondering why on our behalf. Not good enough, Mike.

LikeLiked by 1 person

Coleman’s claims about “proving up” are refuted by readily available statistics on drilling rig activities. These have been at very low levels for some time. He contradicts himself as well because Liberals announced they are delivering yet more subsidies to gas companies in an effort to “protect” jobs.

Everyone in the industry knows there has been no unusual spending in the NE gas fields. That’s why, despite Site C, Fort St. John and Dawson Creek lead BC in housing vacancy rates and unemployment in NE BC is 9%.

Smyth is not a reporter; he’s a distributor of information that spin doctors and political operatives wish to convey to the public without the sources being identified. It’s easy work for lazy people pretending to be journalists. No unproductive time spent reading original sources or visiting the local areas involved.

LikeLike