While BC consumers of carbon pay an ever increasing tax — $10 billion since 2009 — carbon producers are enjoying billions of dollars in subsidies.

While BC consumers of carbon pay an ever increasing tax — $10 billion since 2009 — carbon producers are enjoying billions of dollars in subsidies.

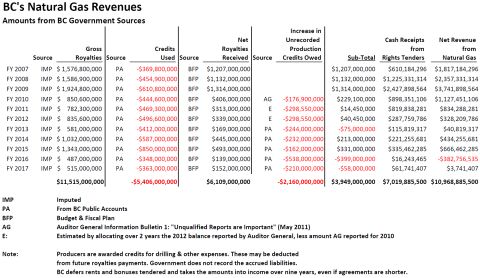

In the fiscal years 2007 through 2017, natural gas companies quietly received benefit of tax expenditures worth almost $8 billion dollars, 71% of that used to reduce royalties otherwise payable to the province. The balance is accrued, available to reduce or eliminate future royalties.

The credit programs are seldom discussed by government or corporate media and the scale of rewards to gas producers never revealed. Any press release from Victoria avoids mentioning total costs. In fact, typical wording purposely creates false impressions. Here are examples of reporting that deceives by omitting full details:

B.C. to extend royalty credit for natural gas industry

Natural-gas drillers awarded $120-million in provincial tax breaks

Pay attention to this quote from BC Liberal Rich Coleman, taken from the Vancouver Sun:

…the program, which was extended by the province in its 2016-17 budget for three more years, at $120 million per year, extending to the end of 2018, Coleman said in a news release.

This is the reality, lifted from various government publications. Assembling this detail is not straightforward and that is by design. Neither government nor industry want us to know the full story.

Gas Revenues 2007 to 2017, the table presented in a pdf version.

The data table shows a serious decline in public revenue over time. Market price of gas is one reason but the volume of gas produced in BC has steadily increased.

Note that in the three fiscal years ended March 2009, provincial earnings from natural gas were $7.9 billion. In three years ended March 2017, the amount was down 96% to a total of $287 million.

Categories: Methane Gas

It’s a mind-twister:

The Gordon Campbell/Christy Clark ‘Clean Energy Plan’ shuts down Burrard Thermal supposedly because of its GHG emissions.

So the $10 billion Site C project, also part of the ‘Clean Energy Plan’, is then necessary, apparently to provide electricity for BC natural gas development, LNG export and the Kinder Morgan pipeline expansion.

Our hydro rates will skyrocket because of Site C, so that GHG-emitting fossil fuel industries can be supplied with subsidized, ‘clean’ hydro-electricity.

LikeLike

Carbon taxation is not revenue neutral, it’s just another subsidy masquerading as a progressive tax! The plummet in royalties is a handout to some of the worst stewards of our environment, how many methane leaking wells could have been remediated if royalty rates stayed at the levels of 17 years ago?

LikeLike

all these carbon taxes on the general public are simply another method of taxation. Better to forget about carbon tax and increase income tax in general. As to subsidies to carbon producers, forget it. We’re paying for it and some of us are very tired of it. it would be nice if we could keep the money in our pockets and use it for our own personal enjoyment.

The Greens may think it will reduce the use of carbon producing “things” but it only impedes those who can’t afford the carbon tax. For those with money, its just business as usual and to hell with those on a lower income.

LikeLike

The philosophy of the common good inherent in a democracy doesn’t seem to be an issue of discussion any longer. Philosophy is irrelevant ? We finance it but it means nothing in court.. There doesn’t seem to be any laws about this social criminality of our politicians in this respect to nuture our democracy.

Time to make up new laws for the prosecution of these politicians, as the trust is gone we used to rely upon for justice.

Life would be miserable without Norm’s insight’s.

Thank you again.

LikeLiked by 1 person

It may be impossible for mere mortals to simultaneously suck and blow, but the government seems quite proficient.

LikeLike

It is so, so sad, that provincial resources have been given away to international corporations and cartels.

I have one word for this and it is “Treason”.

LikeLike

We pay more so Christy and Rich’s benefactors get to pay less. But 40% of voters still believe they are voting in their own interests. Failure of the 4th estate. Or more realistically co-opting of the 4th estate. In my opinion when people are so ill informed they may actually think the regular people that pay the carbon tax are making a difference when the only difference we are making is to the bottom line of the worst polluters in the province. Can we do better?

LikeLike

On topic AND civil? Impossible! This kind of information challenges the right to be civil!

In respect for ‘Leave a reply…’, I will refrain from any blasphemy……..

LikeLike