Canadian fossil fuel industry shills try to explain away the Norway experience as some sort of anomaly that is impossible to duplicate elsewhere. That’s hog wash.

Years ago, Norway made a choice. They decided that when the country’s non-renewable resources were removed, the public deserved a significant share and most of that value should be set aside for future generations. Politicians created a holding fund and invested it internationally to avoid Dutch disease.

The term Dutch disease was coined by The Economist magazine in 1977. The magazine was analyzing a crisis that occurred in the Netherlands following discoveries of vast natural gas deposits in the North Sea in 1959. The newfound wealth and massive exports of oil caused the value of the Dutch guilder to rise sharply making exports of all non-oil products less competitive on the world market. Unemployment rose from 1.1% to 5.1%, and capital investment in the country dropped.

Dutch disease became widely used in economics to describe the paradoxical situation where seemingly good news, such as the discovery of large oil reserves, has a negative impact on a country’s broader economy.

Producers of Norway’s petroleum resources face substantial taxes. When these were imposed, international oil and gas companies asserted the industry would be destroyed because all fossil fuel companies would close operations and depart.

They didn’t. Smaller profits were better than no profits.

Taking a large share of resource wealth allowed Norway to build a national wealth fund that is valued this week at C$1.37 trillion. The country has prepared better than most for a decarbonized economy.

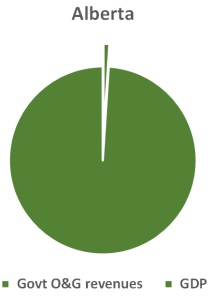

These charts show the relative values of government’s oil and gas revenues, compared to total GDP. In Norway, with 5.3 million people, upstream petroleum companies are subject to a 27% petro tax plus a special tax of 51%. Alberta petroleum tax is less than 4%. BC’s is near zero.

Sorry, BC’s public share of petroleum revenues is too small for my chart maker to pull it out of the main pie.

Categories: Norway, oil and gas

If I were to share these charts on AB social media feeds, I’d get asked for the links to the source documents that provided the numbers. Is it straightforward for you to point to them?

LikeLike

The prominence of information released by government often depends on how politically helpful the data is thought to be. Sometimes, it can be shown with a direct link; other times it must be imputed from multiple sources.

For example, the BC Government does not like to draw attention to the values accrued by natural gas producers through royalty exemption and reduction programs. These began many years ago as tax expenditure subsidies for deep wells, deep discovery wells, deep re-entry wells, summer drilling and infrastructure investments. These programs have become so extensive that credits taken and accrued have exceeded gross royalties in three out of the last five fiscal years (2013, 2016, 2017).

There have been a few press releases in years past drawing attention to certain credits but these announcements are aimed at distracting from the real amounts being extended. For example, this is a Globe & Mail article from September 2013:

In fact, the credits taken and accrued by gas producers in that fiscal year were $819 million yet casual news readers would assume them to be far less.

The value of credits taken and the amounts still owed to producers is only noted as an undisclosed liability in BC’s audited financial statements, published annually in Public Accounts. (Note 29 in 2017). Since the FY 2018 Public Accounts are not yet released, the last definitive numbers are 16 1/2 months old.

LikeLike

did they make a poli donation first?

LikeLike

The facts are appreciated Norm. So rare to come across them in 2018. Our politicians tend to downplay their value. Election time promises seem to work quite well.

LikeLike

Key word : public’ share.

LikeLike