Green Party leader Andrew Weaver spoke to the BC Legislature March 26, 2019. He reported a former insider’s views of why BC natural gas royalty revenues have declined. These were in a letter written by a former civil servant who worked in the oil and gas provincial registry.

NDP, Liberals, and corporate media paid almost no attention to Weaver’s speech. One exception was Times columnist Les Leyne.

Natural resource taxation programs are complex and understanding is difficult because the NDP continues Liberal policies of “less-than-transparent public-facing information.”

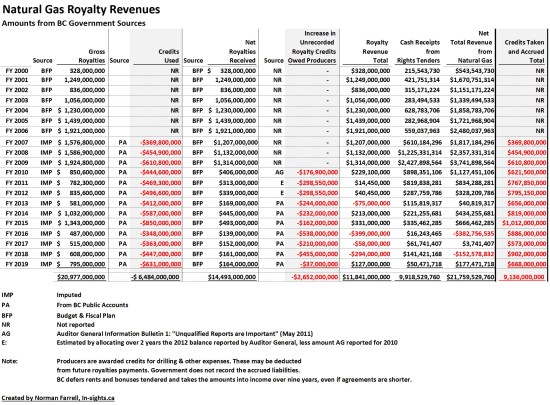

For years, I’ve examined limited financial data made available. Some, like royalty credits, are released once a year, about four months after fiscal year end.

The impact of royalty reduction programs are immense — more than $4 billion in the past five years. Yet, these giveaways don’t titillate the public as does $13 thousand in log splitting tools. So, they remain largely unknown to all but the readers of alternative news sites like this one.

Given the mounting climate crisis, it is reprehensible that governments are facilitating fossil fuel production and largely ignoring developments of clean renewable energy.

Mr. Weaver, an expert on climate science, understands this. But the Greens face a quandry. If they pull support from John Horgan, power would likely transfer to an even more dangerous option.

Following are extracts from Hansard that quote Andrew Weaver.

I’d like to start, because it’s at the beginning of my speech, with what I believe is an incredibly important letter that I received from a civil servant in the province of British Columbia, a civil servant who worked in this government’s oil and gas provincial registry, who has resigned. He has resigned because of what’s going on in B.C. with respect to the LNG royalty regime.

Let me read this letter. This letter was mailed to the Premier, accessible by FOI, and it says the following:

I am resigning today as a public servant and would like to draw attention to certain issues in our province’s gas royalties program and administration. With four years experience as a royalty analyst for the province, five years of field experience in upstream oil and gas operations and undergraduate economics training, I offer my somewhat informed perspective below with the hope of catalyzing increased transparency and perhaps improvement to B.C. gas royalty policy.

The Ministry of Finance and the Ministry of Energy, Mines and Petroleum Resources, EMPR, jointly govern and administer natural gas royalty policy. However, policy is largely controlled by EMPR, with Finance tasked with administering the corresponding royalty calculations based on monthly production data.

Gas production and technology has changed rapidly, along with the economics of this industry, over the past 15 years, during which time our gas royalty policy has remained largely unchanged, with the said extension of the deep-well credit to shallow wells being added.

In my opinion, much of our royalty policy is not functioning as originally intended, leading to unwarranted ballooning of industry subsidy amounts. This expensive subsidy growth is hidden by complexity and less-than-transparent public-facing information. EMPR has become responsible to promote the B.C. natural gas and LNG industry internationally, as well as creating a policy that encourages gas sector growth and profitability.

However, there is a natural conflict of interest between promoting gas producers profitability and ensuring the B.C. public receives a fair royalty for the private extraction of our shared natural resource. A segregation of duty should exist between policy makers and industry promoters but, from my perspective and experience, clearly does not. Consequently, there is no unbiased champion for the B.C. taxpayer’s rights at the policy table, and the costly consequences of this absence are hidden behind complexity.

The Crown has issued more revenue-offsetting deep credits than it has collected in actual total oil and gas royalty revenue. Royalty agreements exist to compensate owners of mineral rights for the removal of their mineral resources.

The deep-well program continues to ensure that B.C. citizens, as collective owners of B.C. natural gas, receive a net negative return for the depletion of our gas resources. We issue more royalty/tax offsets annually than the revenue we receive. Put simply, the Crown is giving out $2 in available royalty tax rebates for every dollar in royalty tax payables.

The deep credit program does not achieve any measurable behavioural impact on industry or benefit society other than increasing the profitability of gas production at the expense of the public.

When the program began, only a small fraction of new wells would qualify for credits. A single deep well produces more gas than many shallower wells. Therefore, fewer total wells needed to be drilled, with less surface equipment and roadbuilding reducing costs and environmental harm.

However, in the past four years, 99 percent of all new wells qualify for the program. An industry would drill these types of wells regardless of our policy, due to the inherent cost savings and productivity gains that arise from horizontal fracking versus vertical fracking and profitability achieved by this modern, commonplace type of well construction.

Royalty tax reduction programs should be employed to change behaviour and solve specific problems, rather than a complex and misleadingly labeled subsidy.

The cost of drilling and completing a deep gas well in B.C.’s main formations has declined drastically over the past decade. Yet our royalty discounts per new deep well remain fixed.

Producer cost of service allowances, another additional royalty reduction program, are calculated based on an approximation of the ‘Crown share.’ The policy compensates producers for certain field-gathering costs associated with the ‘share’ of their production value collected as a Crown royalty payment.

In theory, this means that if the province assesses a 10 percent royalty of the value of a producer’s gas production, we could compensate for 10 percent of the associated costs — i.e., the cost of service.

“In reality, the Crown’s share is approximated by a factor called the weighted average royalty rate, or WARR. The WARR is consistently inflated two to three times higher than the amount we actually collect from producers because this factor is a measure of ‘gross’ royalties before deductions, which are far higher than actual royalties payable.

The average effective royalty rate payable is about 5 percent in the province of B.C., whereas the average WARR — that’s the weighted average royalty rate used in the PCOS allowance calculation — is several times that on average over the last few years. The Crown pays for 10 percent of the costs and receives 5 percent of the benefit.

The total producer-cost-of-service allowances offset Crown revenue annually by over $100 million. In my opinion, the unfair and illogical way the allowance is granted to producers overcompensates them by many tens of millions of dollars per year at the expense of the B.C. public.

The problem is very difficult, if not impossible, to understand by reading public-facing information alone. The policy rewards high-cost operators while disincentivizes industry behaviours that might lower costs or increase efficiency.

B.C. gas royalty policy is exceedingly complex, and the province has made strong efforts to monitor the industry. However, the royalty regime could be greatly simplified by the use of fixed, fair, monthly reference prices for all the product types and assigning fixed, fair costs that would apply to all producers.

In my opinion, a much closer look should be taken at any cross-jurisdictional, royalty-competitive comparisons, as B.C.’s current natural gas royalties includes revenue from gas, liquids and field condensate, which is dissimilar from other provinces, such as Alberta. A comprehensive policy review and simplification could significantly benefit industry, government, staff and the B.C. taxpayer.

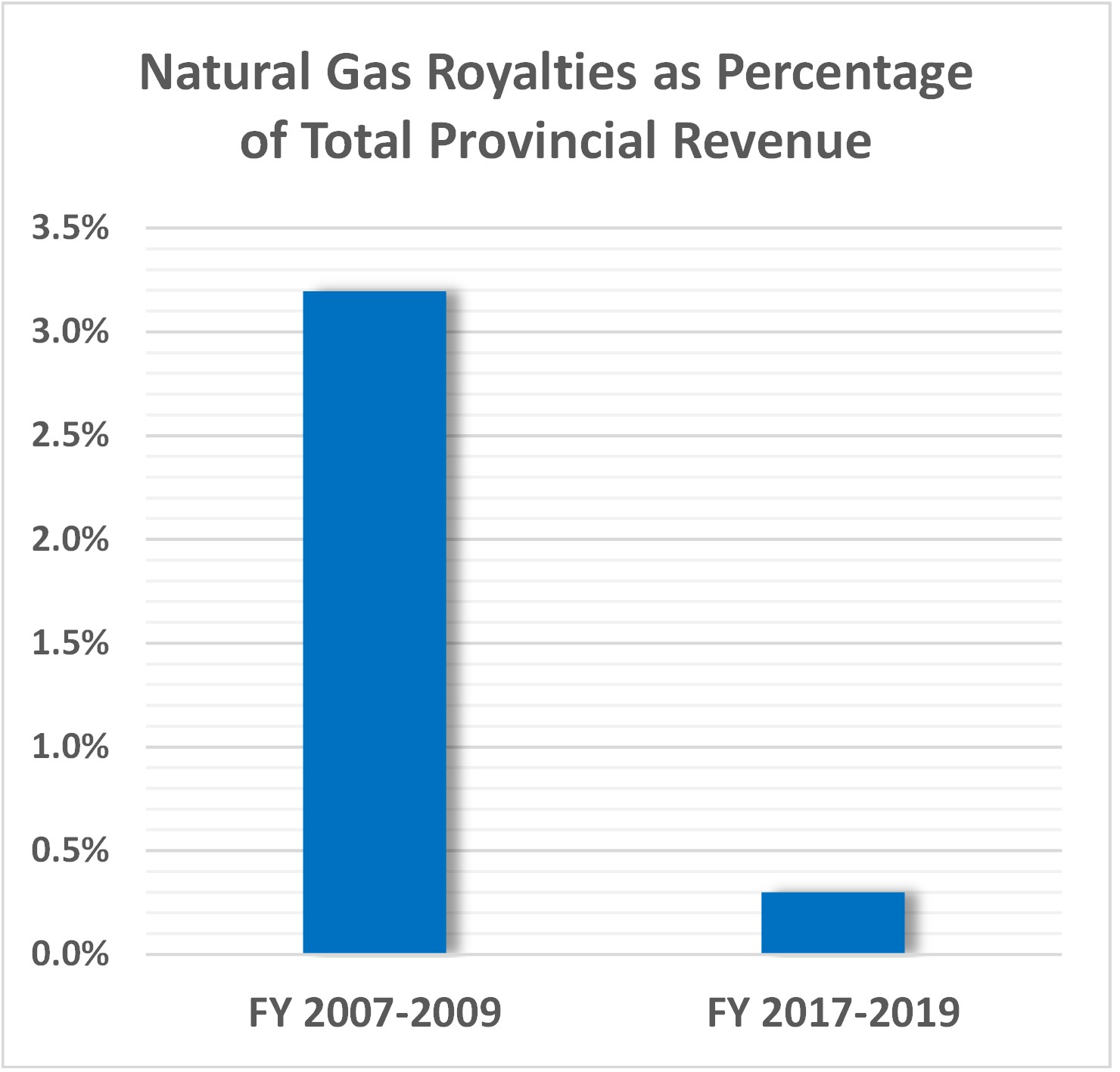

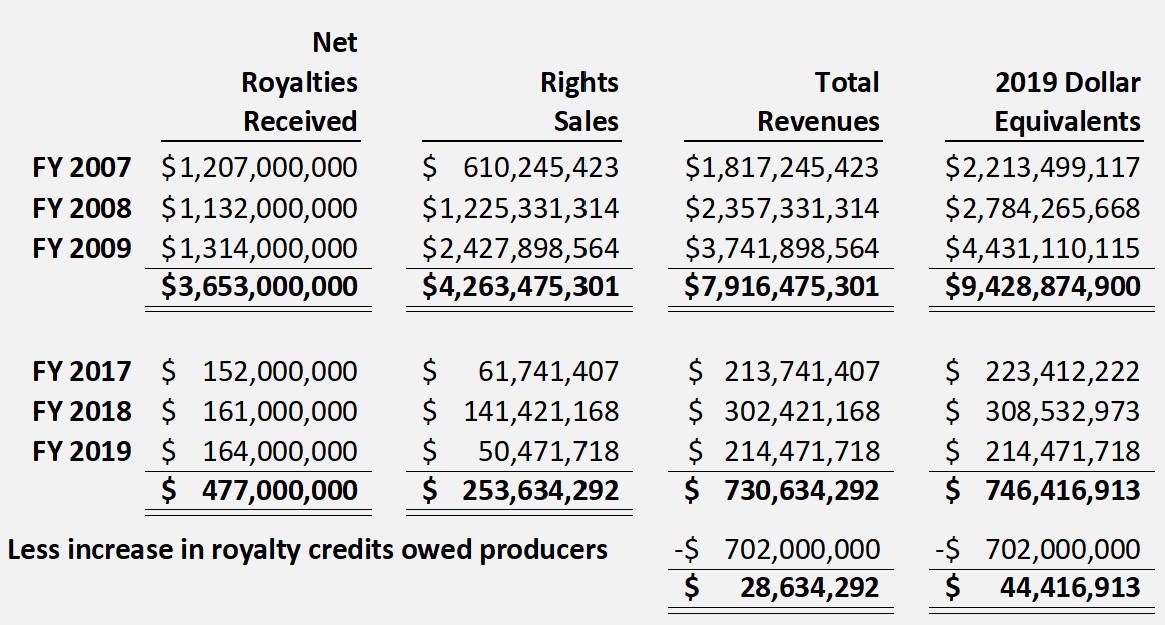

This simple chart shows the impact of royalty credit programs:

Categories: Green Party BC, Methane Gas

People would care if articles like this got into the main media. Oh ya, Those who invest in media also invest in minerals, no conflict there.

SK had (still has?) a royalty free holiday for wells. The greedy companies produced as much as possible while ‘free’ and that turned many wells into low or non producers.

I say follow the money – the new Sask Party under Brad Wall when to Calgary every year to raise money. Who do you think he really represented? Where does he work now? Calgary.

A good documentary, Casino Jack, explains the working principle, even though it is about corrupt politics in the usa.

This will continue until a democratic peoples put a stop to it.

LikeLike

Here is a BC government report that uses charts and graphs from the Fraser Institute and CAPP, and uses Alberta’s oil and gas regime as a benchmark. What’s not to love about a report with those credentials, right?

Click to access 2017_performance_measures_report.pdf

The report’s cover letter from the Assistant Deputy Minister, Oil and Gas Division of the Ministry of Energy, Mines and Petroleum Resources advises that BC’s attempt to remain competitive with other jurisdictions includes:

“…royalty programs aimed at developing unconventional natural gas resources, which include royalty credits for deep gas exploration (deep well program)…”

The letter from the ADM’s former employee quoted by Mr. Weaver describes the deep well program thusly:

“The deep credit program does not achieve any measurable behavioural impact on industry or benefit society other than increasing the profitability of gas production at the expense of the public.”

I believe the former employee, and believe BC’s attempt to “remain competitive” is exactly what Norm so accurately dubs it. A generational sellout.

Mr. Horgan has done a lot of very good things for BC since becoming Premier. But he gets an “F” on this file.

LikeLike

Norm i was just wondering when the next time you were going to be on the “top dog” radio station to explain the travesty of financial incompetence that was perpetrated on us by the

BC Neo-Liberal party and enthusiastically continued by the NDP? Or does Andrew Wilkinson have airtime booked from now until the next election ? They should just go all in and give him his own show he is on there so much. It’s sad that the 2 million people of the lower mainland have been guilted into shouldering the climate fight for the majority of the planet and the whole of Canada .And then with their other hand Horgan and Co are going to basically double our greenhouse gasses over the next decade while giving up any and all royalties for the working stiffs of BC. Meet the new boss …. worse than the old boss. At least Gordon Campbell got us paid. That is so sad.

LikeLike

Don’t hold your breath waiting to hear me on corporate media. Even though material published at In-Sights is based on verifiable data, disclosures are not welcomed by corporate interests. Media would rather feature industry friendly operatives and shills like Stewart Muir of Resource Works and nutritionist turned pro-oil activist Vivian Krause.

LikeLike

I love what you stated and related about corporate media. Good on you Norm.

LikeLike

And look what was even just as bad or even a worse disaster in my opinion that was perpetrated on British Columbians by the dirty BC Liberals leadership regarding money laundering. Their equally dirty casino operator buddies and the hierarchy of BCLC bottom feeders not to mentions all the pigs in at trough who are guilty also. An unmitigated massacre of public protection. I sure hope the public inquiry isn’t a disaster, because it would be one of the thousands cuts to the demise of the NDP.

But yeah, these Horgan nincompoops are just as bad in their own right. The people just stay at the side of the curb, not of our own doing, but by the people we hire and pay to protect the people’s interest.

LikeLike

Not being anywhere being close to knowledgeable on the natural gas issue and as a layman on the issue, all I can say is that I thought a royalty was a cost on the specific volume of gas (or oil) delivered at the well head.

That the royalties for the gas product have all but disappeared I will make an assumption that the government is in ka-hoots with the gas/oil energy in preventing income (i.e royalties) being made for the people of BC.

In my book this corruption, corruption that leads directly to the Premier’s door.

LikeLike

More specifically a royalty is represents share of the value of the resource that is transferring from public to privare ownership upon extraction. These resources are being given away to private co’s for next to nothing, without actually lowering the (visible, intuitive) royalty *rates*. Instead, the valuation of the gas is lowered, and credits and deductions are applied to the royalties assessed, until we are left with a rounding error of what used to be considered a fair share.

LikeLike

Sorry – first sentence should read, ” …a royalty represents a share of the value of the resource…”

LikeLike

Back when I was one of the last of a dying breed, ie a smoker, I realized that I was actually paying them to kill me. I quit.

LikeLike