Governments impose carbon taxes ostensibly to deal with climate change by reducing greenhouse gas emissions. But effectiveness is limited since the taxes are not applied broadly or at levels sufficient to reduce or compel reduction in fossil fuel production and consumption.

British Columbia did not impose a carbon tax to protect the Earth from dangers of greenhouse gases. Aiming to build his personal reputation and ensure a market for privately produced electricity, Premier Gordon Campbell sought praise for BC’s environmental sensitivity.

Campbell introduced the carbon tax in 2008 and stood in the spotlight as California Governor Arnold Schwarzenegger praised his ambition. The BC Premier then spent a week at Copenhagen 2009’s United Nations Climate Change Summit holding photo ops with celebrities. Campbell carefully avoided criticism of the Harper Government’s lacklustre involvement in the conference.

To gain support for the measure at home, Campbell promised offsetting income tax cuts would make the carbon tax revenue neutral. BC Liberals didn’t want people to think this was just another tax grab.

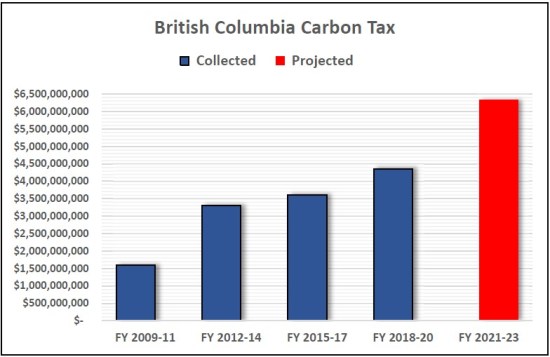

Of course, it was another tax grab. A grab Carole James’ BCNDP opposed in 2008 and John Horgan’s BCNDP thoroughly embraces in 2021. Ironically, carbon taxes have replaced provincial revenues that once were gained from natural gas royalties and rights.

Has the Carbon Tax Act of British Columbia improved the world’s greenhouse gas emissions?

Not if you consider that natural gas production in BC doubled from 2008 to 2020. Additionally, coal exports increased 20% from 2008 to 2013 and have grown since then, although the actual change is concealed since Statistics Canada suppresses the information to meet “confidentiality requirements.” We do know that British Columbia is now North America’s leading coal exporter.

BC’s carbon tax is not only a major cash generator for government, it provides cover to politicians who are de facto climate change deniers but want to dispute the label. That cover enables the BC government to provide subsidies and tax waivers worth billions of dollars to fossil fuel producers and processors, yet still publish propaganda pretending the province is acting seriously on climate change.

The BC Carbon Tax Act exempts certain carbon producing activities and allows other exemptions to be added by regulation. Government chooses to be wilfully ignorant about unmeasured oil and gas emissions in upstream and midstream activities and imagines that BC coal and natural gas burned elsewhere emit no greenhouse gases.

If provincial politicians were truly concerned about building a more sustainable, more hopeful future for the Earth, BC would be ending production of fossil fuels and accelerating transition to non-destructive renewable energy sources.

Categories: Climate Change, Taxation

And to think of the revenue the Government could make if we carbon taxed the coal, oil and gas that we export. Maybe NG should be double taxed cuzz it’s fracked. Naw, won’t happen. Our Governments are too interested in having a colonial mentality in giving away our raw resources.

LikeLike

The Carbon Tax was a renamed governmental tax to offset the massive tax reductions given to the wealthy in BC.

It was never an environmental tax.

Of course Horgan embraces the Carbon Tax, the government is loosing revenue from illegal money laundering.

Gordon Campbell, Christie Clarke, John Horgan, and soon Kevin Falcon are the destroyers of this province, where corporate wealth, out plays the provincial good.

LikeLike

In BC we’ve been paying the carbon tax since 2008, but sales of gasoline and diesel are up since then:

https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=2310006601&pickMembers%5B0%5D=1.11&cubeTimeFrame.startYear=2006&cubeTimeFrame.endYear=2019&referencePeriods=20060101%2C20190101

LikeLike

Fossil fuel industries pay carbon tax on consumed items, such as fuel burned in trucks during production. Government largely ignores emissions of methane during production and transport of natural gas. No one counts greenhouse gases from shipping and consumption of natural gas and coal outside the province.

So, BC could multiply fossil fuel production by a factor of 100 and politicians would still say we are dealing with climate change because Grandma pays carbon tax on fuel used to heat her home.

As reported elsewhere on In-Sights, BC used to get billions of dollars each year from royalties and sale of petroleum and natural gas rights. Those are now minor sources of public revenue.

LikeLike

Norm, such abuse of carbon taxes is (disheartening) news to me, as someone deeply concerned about Canada’s and BC’s lack of progress on GHG emissions reductions. We have the expertise to be green energy transition leaders internationally, with well-paying jobs that leave no one behind, rather than (essentially) being cheating collective laggards.

Question: Presumably the carbon taxes paid by BC’s fossil fuel industries are now less than the royalties they used to have to pay years ago, before the BC government waived the royalties?

Additionally, as you write, those “tax grab” carbon taxes allow the “BC government to provide subsidies and tax waivers worth billions of dollars to fossil fuel producers and processors.”

LikeLike