Many people think of Canada as one of the more socially advanced countries of the world. This view is reinforced by OECD’s Better Life Index where Canada placed fourth in 2020, the World Happiness Report, which ranked Canada 15th in 2021, or the Social Progress Index that graded Canada sixth in 2021,

The Social Progress Index was created by professors at Harvard and MIT with the non-profit Social Progress Imperative. the index ranks social and environmental measures that underline well-being and opportunity. This is how SPI viewed Canada:

If you want to move up in the world, move to Canada. Our neighbor to the north ranks first in the world in providing Opportunity to its people, ninth in Personal Freedom and Choice, and third in both access to Advanced Education and Tolerance and Inclusion.

But instead of progressive, Andrew Mitrovica, long an unapologetically bold columnist, labeled the country pedestrian.

Would-be privatizers of public healthcare hold sway in parts of Canada — particularly Alberta — but public support remains strong for a system that ensures people can enjoy access to medical treatment without fear of family bankruptcy.

Pensions though have been an easier target for neoliberalism because people tend not to think about retirement until later in their working lives. For some, that is too late. In 2018, a CIBC poll said about one-third of Canadians between ages of 45 and 64 have nothing saved for retirement. As employer pension plans disappear in a gig-economy, this problem is growing worse.

The economic havoc wreaked by the coronavirus pandemic will fuel the gig economy as companies become increasingly wary of hiring permanent staff and rising unemployment leads to an increase in the number of individuals seeking contract work.

Coronavirus set to fuel gig economy growth

The Broadbent Institute found ‘voluntary’ options for saving, RRSPs, TFSAs, etc. are inadequate to address shortcomings in workplace pensions and limited benefits offered by the Canada Pension Plan. Tax deferred savings accounts work extremely well for the wealthiest citizens, and work not at all for the poorest.

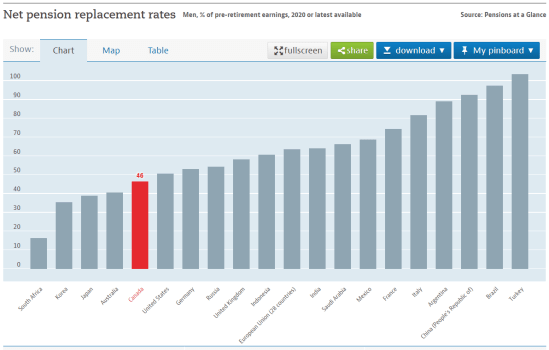

Looking through statistics published by Organisation for Economic Co-operation and Development (OECD), I was rather surprised at how badly that organization regarded pension systems in Canada.

Among G20 nations, male and female pensions for Canadians rank 16th:

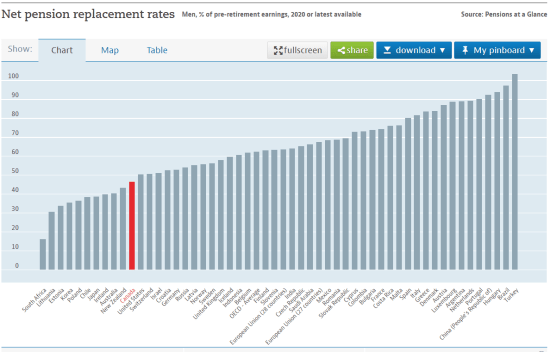

In a larger listing of nations, Canada ranks very poorly. It is not a subject I have studied thoroughly but some of the countries placed near the top surprised me.

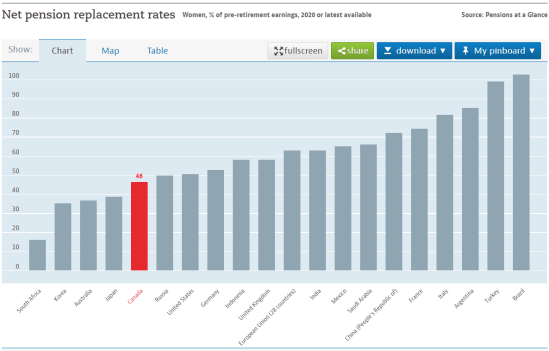

According to OECD, Canada does a little better in terms of gender gap for pensions but still ranks below the middle:

International consulting firm Mercer places Canada higher in its overall evaluations of pensions but ranks the country 15th in adequacy and 21st in integrity. Twelfth place overall seems a stretch in Mercer’s ratings but mysterious forces can sometimes influence ratings.

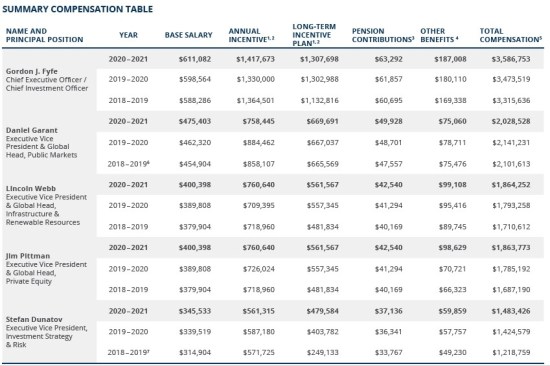

From the average beneficiary’s point of view, Canada may have far from the best pension plans in the world, but I’d wager we have the best remunerated pension fund managers in the universe.

Nobel Prize winning economist Joseph Stiglitz wrote that the American system is rigged in favour of a small minority of citizens. According to Stiglitz:

The American political system, coupled with high initial inequality, gave the moneyed enough political influence to change laws to benefit themselves, further exacerbating inequality.

Breaking this feedback loop by curbing the power of money in politics is essential to reducing inequality and restoring hope.

The American Economy is Rigged

It is no different in Canada.

I’m game to live to 175, if Norm will keep writing.

Happy New Year every one. Lets hope something is done about pensions, perhaps the real trick will be to increase salaries.

LikeLike

👍

LikeLike

What irritates me the most is that cpp funds are not even government monies. IT’s money from each of us and our employers.It was supposed to be administered by the government and invested for us Look how that has worked out. Not only that but we were taxed on that money before it was taken off our pay checks and we’re taxed again when they put it in our accounts.

On top of that how many times did they raid the piggybank for capitol projects in the early days of cpp?

Even now I don’t think there is too much oversight on investments as there should be.

LikeLike

I believe Canada Pension Plan keeps many people out of abject poverty. By itself, the benefit is insufficient to sustain comfortable living but without CPP, many Canadians would be living in harsher circumstances. Is it adequate for the future? I think not, but an influential contingent of Canadians believe that individuals should make their own preparations for retirement and if they don’t, they should spend their final years in need.

Actually, CPP contributions reduce taxable income for both employer and employee. So when CPP amounts are removed from paycheques, they come from pre-tax dollars and as the value of the pension rights increases through investment profits, income tax is deferred on that gained value.

Of course, taxes, like death, are inevitable so when we start receiving payments from CPP that are funded by the two sources of contributions plus investment profits, the amounts are taxable in the hands of the recipients.

Management of CPP funds is independent from government. CBC reported:

LikeLike

Thanks Norm: disregarding the “influential contingent of Canadians (who) believe that individuals should … spend their final years in need” the CBC’s report that “… at the very least, there will be no shortfall,” is a pretty low bar for a program that characterizes itself as an “investment fund.” Google “CCP Investments” for glowing self-congratulatory prose, and keep in mind that after 40 years of escalating employee and employer payments, this so-called “fund” – if you qualify – pays your heirs a princely $2500.00. In retaliation I shall endeavor to live to at least 175!

LikeLike

After death of a person over 65 years who is collecting a CPP pension, their surviving spouse or common-law partner will 60% of the contributor’s retirement pension, IF they are not receiving other CPP benefits. (That’s a mighty big IF.)

Living to 175 may the only way some of us beat the system.

LikeLike

The only way too beat the dirty and greedy and corrupt system.

LikeLike

The problem with this chart is that it measures only one part of the seniors financial support system, and the social equity chart in the report rates Canada much higher because of the range of other social transfers benefiting seniors, such as rent subsidies, Pharmacare, GIS, etc.

It always helps to read the full report rather than cherry picked data.

Context is important. For example, Costa Rica is a good example with a high net replacement rate of 107%, but with a seniors’ poverty rate twice that of Canada.

LikeLike

True that financial security involves more than the level of income replacement provided by pensions.

But social benefits available to Canadian seniors should not be oversold. Rent subsidies and GIS are provided to the most impecunious. Income that excludes a person from receiving GIS is well less than needed to pay rent on most one-bedroom apartments in Metro Vancouver.

Canadian pensions often have “maximum pensionable earnings” limits that result in plan beneficiaries receiving pensions below amounts they earned before retirement. That may be the element most responsible for Canadian pensions ranking low in income replacement.

Many privileged people in government and private enterprise are not subject to pensionable earnings limits. More than a handful of them enjoy multiple pensions when they retire.

Rules always favour the rule makers. But the main warning to consider is that a pension system that might have been okay 25 years ago, is becoming more inadequate as time proceeds. That 2018 survey that found one-third of people within 20 years of retirement age have NOTHING saved for retirement is scary.

LikeLike

Mike Flynn correctly comments that in Stephen Harper’s eyes, CPP is just another form of tax.

But do you remember how Harper’s Finance Minister, Jim Flaherty, gushed with praise for the CPP? No wonder! Not only did the CPP provide his friends with lives of opulence, but it compulsorily dipped into the pockets of all working Canadians who never seemed to protest too much.

Why? Because, as Norm Farrell accurately points out “…people tend not to think about retirement until later in their working lives.” Of course, the CPP is a tax. They call it a “fund” but it dies with the contributors, leaving nothing for their heirs.

Oh yes, there’s the contemptible “Death Benefit.” Capped over two decades ago at a maximum of $2500.00, this paltry amount won’t even bury you – a final farewell, with thanks for your generosity, from the Titans of Bay Street.

And speaking of their lacklustre performance and stingy payouts: compared with the CPP, the entirely non-contributory GIS that pays almost as much but has the additional advantage of attracting subsidies and allowances, yields a superior package. I don’t begrudge GIS recipients their assistance, but the inequity, when 40 years of the CPP’s enforced so-called “contributions” are added up, is ridiculous.

And to add insult to injury, CPP is fully taxed but GIS not at all, and CPP is treated as income that reduces eligibility for GIS. What’s that – a quadruple whammy?

I would like to see Norm’s excellent financial and analytical skills applied to a deep dive into this subject for the benefit of millions of hard-working Canadians. I can suggest a title – “The Great CPP Rip-Off.”

LikeLike

Certainly agree with Mike Flynn regarding “RRSPs is a welfare program for Mutual Funds/Investment Industry.

A few years ago, in Ontario, it was reported the largest group of people declaring bankruptcy were retirees. Things are not going to get better. About the only way to survive retirement is to have a fully paid for home or an inheritance. A lot of pensions are not indexed, so if you live 20 years after retirement, your income is not going to keep up with inflation. Even those who have indexed pensions won’t be doing that well because the rate of inflation is always much higher than the true cost of living.

Some who have money will argue people ought to plan, but given low wages, high cost of living how does some one save for anything, given they can barely get by on a monthly basis or haven’t they seen the people at the food bank.

Canada does need a new pension system, one which guarantees people a decent standard of living. I’m sure if you checked with social agencies you’ll find there are more and more seniors winding up in homeless shelters. Either the government starts building affordable housing for seniors or they increase pensions.

Norm, thank you for writing this article. In between COVID and other health crisis in the country, seniors are being forgotten.

LikeLike

Part of the problem is that we have Prime Ministers who appoint “self-serving screw-up’s” onto the Canada Pension Investment Board. Just have a look who Stephan Harper appointed. Also Stephan Harper was dead against any Government Pension system because, in his eyes, pension contributions are just another form of a tax. Here in BC we have some of the highest paid bandit administrators in the BC Government Pension Plan board. In my way of thinking, all forms of Government pension schemes can be enhanced in a heartbeat. RRSPs is a welfare program for Mutual Funds/investment industry

LikeLike