Oklahoma is indisputably a right-wing Republican stronghold. One expects the state to be in the grip of climate-science denying fossil fuel advocates. Yet 100 kilometres northwest of Oklahoma City, the continent’s largest wind farm constructed in a single phase began delivering electricity.

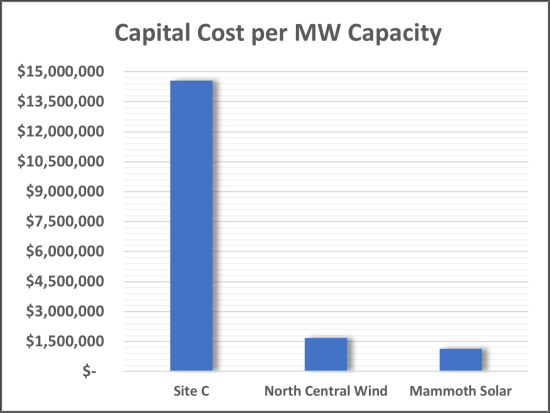

Traverse Wind is one of three parts of Oklahoma’s North Central Wind Energy Facilities (NCEF). The wind projects have generating capacity of 1,485 MW and a capital cost of C$2.5 billion. Output is marketed by American Electric Power, a utility on a belated carbon reduction program. AEP executive Peggy Simmons explained the company’s commitment to non-destructive energy technologies:

Many businesses looking to expand or relocate to Oklahoma want to know about our investment in renewable energy. We’re redefining the future of energy and developing forward-thinking solutions that provide both clean and affordable energy to power the communities we serve.

Completion of Traverse Wind came only one year after renewable energy developer Invenergy announced the project had secured construction financing.

Compare that to British Columbia’s Site C:

- While initially proposed in the mid-1950s, BC Hydro first announced Site C construction in 1979;

- Shelved in 1982, it was revived in 1989;

- Shelved again in 1991;

- Declared dead by BC Hydro in 1993 because of excessive financial and environmental costs;

- Revived by Gordon Campbell in 2001;

- BC Hydro promised in 2004 that private sources would cover 99% of Site C’s projected $2.1 billion cost;

- In 2008, BC Hydro stated project cost would total between $5 billion and $6.6 billion;

- In 2011, BC Government announced Site C will be operational by 2020, with 900 MW capacity;

- BC’s Minister of Energy said in October 2014 the Site C budget of $7.9 billion budget, vetted by the world’s top experts, was assuredly reliable;

- In 2014, cost of the now 1,100 MW dam increased to $8.335 billion, then to $8.5 billion, and finally to $8.775 billion;

- In 2017, reversing opposition to Site C expressed while in Opposition, NDP Premier John Horgan announced Site C would continue with a revised budget of $10.7 billion;

- A BCUC report found he Site C could cost more than $12.5 billion and other renewable energy sources could provide the same amount of power for $8.8 billion or less;

- In February 2021, BC Government announced the Site C budget had been increased to $16 billion and completion delayed until 2025.

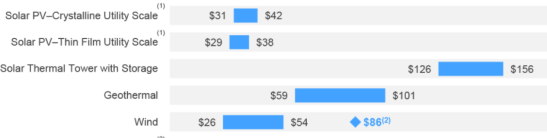

In 2011, when Site C was budgeted at $7.9 billion, BC Hydro stated it would produce electricity at a cost between $87 and $95 per megawatt hour. With its budget now doubled, Site C electricity will cost a great deal more. Meanwhile, leading financial advisory and asset management firm Lazard Ltd. reported levelized costs for alternatives in 2020 as low as US$26. Wind and utility-scale solar now cost a small fraction of Site C power:

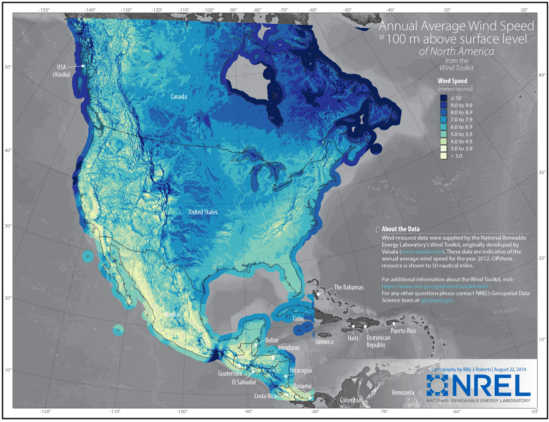

The shift to wind power is just beginning. International Energy Agency (IEA) calculated offshore wind could almost meet global electricity demand projected for 2040. According to IEA, offshore wind:

…is a rapidly maturing renewable energy technology that is poised to play an important role in future energy systems. In 2018, offshore wind provided a tiny fraction of global electricity supply, but it is set to expand strongly in the coming decades into a USD 1 trillion business. Turbines are growing in size and in terms of the power capacity they can provide, which in turn is delivering major performance and cost improvements for offshore wind farms.

Offshore Wind Outlook

In February 2022, the Bureau of Ocean Energy Management accepted bids worth C$5.5 billion for offshore wind energy leases off America’s northeast coast. In just six proposals, the installed capacity is expected to be between 5,600 MW and 7,000 MW, enough to power two million homes. Large sections of North America, particularly coastal regions, can power the continent with wind.

According to Lazard in 2019, wind energy prices had fallen 70% and solar photovoltaics fallen 89% on average in the preceding decade. Experts predict declines will continue as these technologies mature.

In October 2021, Doral Renewables started work on Indiana’s Mammoth Solar, North America’s largest solar energy farm. The C$1.875 billion project, expected to be fully operational by 2024 has planned capacity of 1,650 MW. An Australian solar farm is planned to be more than double the size of Mammoth and such facilities will grow larger in the future.

Immense capacity and attractive economics dictate that use of the wind and solar technologies will accelerate. IRENA reported in 2019:

Going forward the solar industry has very clear cost-reduction roadmaps, which should see solar costs halving by 2030. There is already a move in place towards higher-efficiency modules, which can generate 1.5 times more power than existing, similarly sized modules today using a technology called tandem silicon cells. These are going to have a large impact going forward.

Future Looks Bright for Solar Energy

Transformative technologies for generating and distributing electricity have been steadily resisted by BC Hydro and BC government officials. That is not surprising since lower cost, more efficient operations are not part of the public utility’s business strategy. The company’s approach, driven by self-interest and political considerations, maximizes expansion. This leads to lavish financial rewards for executives, senior technologists, favoured consultants, and friendly suppliers and contractors.

Interests of consumers, whether residential or small and medium-sized enterprises, are largely ignored. The information noted above has been known by the utility and the BC government for years, but while Site C is ill-suited for BC citizens, it thoroughly meets the aims of provincial decision makers.

As managed since 2001 under Premiers Campbell, Clark and Horgan, BC Hydro has been an unqualified disaster. The company has used falsehoods to justify capital spending of about $40 billion during a decade and a half of flat demand. Instead of managing BC Hydro for the benefit of citizens, political officials in BC have directed or assented to disastrous utility policies.

This is another case of supervision by policy regulators who do not believe in regulation. To them, private interests are foremost, public interests subordinate.

The way forward is privatization of BC Hydro and creation of a strong, independent, and unassailable regulator that ensures citizens are protected from capitalist profiteering and self-interested financial fraud orchestrated by corporate insiders and politicians.

A very well done article Norm , so thanks.

Perhaps I could add a few thoughts some of the folks could start thinking about.

The first one is , why does the BC Auditor General think it necessary to remind BC Hydro about FRAUD, as he just did with his recent report? I can speculate that he might have already come across some worrisome examples with Site C contracting. After all SNC Lavalin has the same kind of reputation that MacQuarie International had 10 years ago and yes the BC Government did/does business with both.

Perhaps more worrying for me is the fact that a former AG reported that BC citizens had contingent liabilities exceeding $100 billion, an amount no BC politician, other than Paul M. , would talk about.

Five or so years ago I tried twice by addressing the pre-budget legislative road show here in Nanaimo.

Ever since Prem. Campbell made contracts secret the taxpayer in BC has no idea what he put on the table to get a deal and Horgan is following the same path. What folks have no understanding of is how much of our sovereignty is at risk in baking up off book financings.

I and others were shocked a year ago by the annual financial report of the Canadian Pension Plan.

It was the independent Auditor who disclosed that the CPP IB was carrying over $100 billion of financial liabilities. Even after Paul helped us with a program to have our concerned read out in Parliament, the Finance Minister would not reply as to how this was to be fixed.

I think people should be very concerned by the idea of a dam at Site C where the foundation is on nothing but compressed mud.

LikeLike

How about a BCHydro class action lawsuit for breach of a public trust and fiduciary duty .?

https://biv.com/article/2021/11/bc-hydro-among-agencies-lacking-anti-fraud-measures

Flat domestic demand for 17 years.?

but telling public 2% growth for 20 years then dropping it to 1% for 20 years.

LikeLike

I am surprised that the BC government has not amended its building code to compel new build residential housing to include wind and solar power to offset power consumed off the grid. There devices now on the market, costing $10K to $15K, that can do this quite well and will not greatly increase building costs.

As for hydro power, it ain’t clean, not by a long shot as the drowned foliage in the massive reservoirs supplying water for the hydro dams, release vast amounts of methane and destroy the local environment.

At the moment, heat pumps are the flavour of the month, but I believe that local generation of electrical power is a must. One only has to look at European residential areas, where houses with solar panels on their roofs vastly outnumber those that don’t

LikeLike

The danger of Hydro privatization is the fact the water behind the dams is a public resource of all BC citizens. The private sector (Canadian and US) have long argued for access to the water for their profit. Our provincial government in the last 15 years as given the private sector the construction control and in some instances outright ownership of the dam project (SNC Lavalin).Our citizenry is aware of climate change and the impending disasters like heat domes and massive flooding. Our water must be owned and controlled by responsible government.

If we choose wind, solar, massive hydro or other generation we must maintain ownership and control of our water.

LikeLike

Bingo.

Wendy Holm identified that specific hazard with the project: ithe reservoir is at the exact point determined by the US Army Corps of Engineers to be optimal for diversion of water headed to the prairies southwards.

All that would be needed under NAFTA to be able to treat that water as a commodity rather than a resource of both Canada AND the territories upon which it is superimposed, would be for it to no longer be “free flowing” (reservoir) and for it to be privately owned.

It might be noteworthy that to the best of my knowledge BC Hydro has mysteriously been bleeding money consistently since almost exactly the point in the 2000s when it was being resurrected; and California ruled that water could be traded as a commodity as of Dec 01, 2020.

LikeLike

Keeyask muskrat bipole3 update you will manually have to look up as BC local media rarely posts

LikeLike

So your idea is that if BC Hydro were privatized, it would have to compete against other private companies supplying electricity with wind and/or solar?

Like the other commenter, I’m uneasy about privatization of a basic service and relying on a competent and trustworthy regulator.

LikeLike

“When international energy agencies say that wind and solar can supply future energy needs, they are accounting for electrified road transport. ”

No. They are delusional. Wind power is the most expensive, least efficient and most environmentally costly power production out there…and solar is not much better.

Hydro-electricity is BY FAR the best option for mass ( why do people always forget that part?) energy production. Nuclear is probably number two. People who promote this scam may or may not be liars (they might just be ignorant or uneducated on the issue)…the really despoicable ones are the people who *make money* foisting these white elephants on us.

Take away all the subsidies and see how ‘competitive’ your windmills are.

LikeLike

I gather you didn’t have time to read the article. Or, do you just reject facts that don’t fit your preconceived notions?

LikeLike

Just curious as I don’t know. What if any would the moving to EV’s (for those that can afford it) have on BC Hydro (us)?

Residential Solar in BC seems like a mugs game when you don’t see much sun in some areas (mine) for 6 months. Payback is still pretty long in the tooth and players would probably need to be on the younger side. Maybe cost could amortized as rent and paid as part of a mortgage. Is there commonalities of material between EV batteries and solar panels and if so what would be the priority? The market?

Only so much finite component material to go around if that is true. Depending on roof pitch perhaps opportunity for snow removal off panels on roof of the home if owner can’t. Maybe the price of natural gas and push to geo thermal will be the nail in the coffin to get the whole province to move to Miami.😀

Why no mention of conservation by consumers and the technological drive to completely digitize and plug in our living and entertainment environment never mind home air conditioners installs to offset the next heat dome? The grid is becoming another Achilles heel to our survival. More dams ? We need less demand not more consumption.

A good example of regulators gone bad is next door to BC. Alberta. Jessica Ernst took on the Oil and gas Industry (fracking in Rosebud) and the Alberta overseeing Regulator all the way to the Supreme Court of Canada and lost. It financially crushed her. So much for regulators.

I just have a hard time supporting the privatization of a basic service of such importance to everyone. Capitalism (bottom line greed) is just a too powerful drug. Examples run abound.

LikeLike

When international energy agencies say that wind and solar can supply future energy needs, they are accounting for electrified road transport. No one denies that electricity supplies must grow; discussions involve the methods of creating that form of energy.

Solar panels already work in locations known for cloudy, cooler weather and panel costs have been dropping while efficiencies have been rising. However, the cost of electricity from the grid, rather than the number of cloudy or sunny days, is a key factor in determining usefulness of solar power to individual consumers.

Electricity rates in BC have risen far more than the rate of inflation but increases have been moderated by the supply of very low-cost energy from facilities built long ago. For the last 15 years, BC Hydro has been adding high-cost electricity to the grid and selling electricity to favoured consumers for less than the acquisition cost of new energy.

A dangerous trend is firmly established, and BC Hydro’s future financial problems will only be resolved by the utility charging significantly higher rates to residential and SME consumers.

Rooftop solar installed by consumers will become steadily more attractive.

LikeLike

In theory: you make a good argument.

In practice: the political party most likely to do this would ensure that the regulator was toothless and captured.

LikeLike

Indeed. Ordinary citizens are stuck between a hammer and the anvil.

Ten years ago, Nobel prize winning economist Joseph Stiglitz wrote that a single family, the Waltons, possessed combined holdings equivalent to the wealth of the entire bottom 30 percent of Americans. Since then, inequality has increased.

People enjoying extravagant lifestyles by exercising political influence will not abandon that influence. Accordingly, despite my suggestion here, I hold no expectation that management of BC Hydro will change or regulation of monopolies will suddenly be made independent and effective.

LikeLike