The Professional Institute of the Public Service of Canada (PIPSC), an organization that represents about 12,000 tax professionals at Canada Revenue Agency, says it clearly:

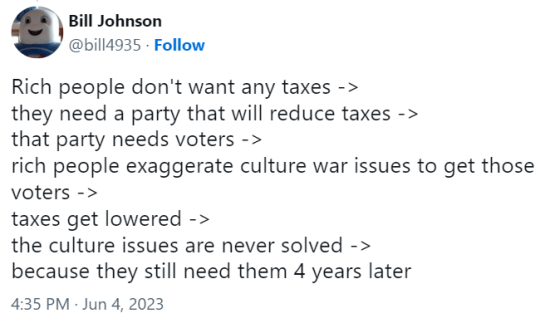

Wealthy corporations and the ultra-rich don’t pay their fair share.

Canadians have had enough of the tax-cheats gaming the system to protect their pocketbooks at the expense of everyone else.

Gaming the system is easy if you have enough money. Let’s change the game. It’s time the wealthiest pay their fair share.

Our members have been flagging concerns about wealthy corporations avoiding paying their taxes. Tax-cheats are using aggressive transfer pricing or profit shifting strategies. High-profile investigations like the Panama, Paradise and Pandora Papers further expose the global tax avoidance crisis.

Parliamentary Budget Officer (PBO) Yves Giroux issued Preliminary Findings on International Taxation in 2019. Giroux’s report addressed the multi-billion dollar tax gap, which is the difference between taxpayers’ theoretical liability and the amount of tax paid.

Part is attributed to illegal tax evasion, and another part to tax avoidance, which includes actions that may be legal, but offend the “object and spirit of the law”. The latter, said the PBO, is measured by few countries so is difficult to quantify.

Transfer pricing plays a central role in the operation of global markets and transfer pricing fraud is routine for multinationals. Tangible goods may move from one country to another but financial transactions are routed electronically through other nations. Profits end up in low-tax jurisdictions, protected by money sheltering locales paid handsomely to maintain secrecy.

In 2021, New York Times reported that at least 55 of America’s largest companies paid no taxes last year on billions of dollars in profits.

According to the PBO estimate, losses to Canada’s public treasury are immense. From the PBO’s conclusion:

. . . if we assume that 10 per cent of the $1,639 billion in outgoing EFTs to OFCs identified in Table 2-2 has avoided taxes, this would represent approximately $164 billion in taxable income and $25 billion of tax revenues lost.

Twenty-five billion dollars, more or less, each and every year. Probably more. According to Canadians For Tax Fairness:

Corporate tax avoidance is not a new problem. Rather, the enormous increase in the corporate tax gap for 2021 suggests that a persistent problem may be growing worse.

Categories: Tax Evasion & Avoidance

In the 1990s my self and a US partner were trying to sell diatomaceous earth to a local cement producer so they could bag and sell a special type of cement. The physical product was to come out of Northern California and delivered to Burnaby, BC.

We were advised that our paper work would have to show delivery to a tax haven but the physical delivery would be direct from California to BC. If this was a problem for us there would be no purchase agreement.

This was the pattern of all business that thought they could get away with it.

Taxation gaming has been around since at least the 1970s.

LikeLike

A Flat tax has been discussed for decades.

Everyone, rich or poor, pays 5% or say 10% tax on ALL earnings.

Can you imagine how many accountants, lawyers and support staff will be unemployed one day after a flat tax is announced?

The problem is ….there are ALWAYS other tax havens.

So if your country wants to implement a “fair” flat tax….the rich will leave to another country that doesnt have a flat tax.

Anyone notice the billionaire family the Irvings of eastern Canada have just proposed selling their entire business this week?

The shipyards, the oil refineries, the gas stations, the tv/radio/newspapers?

perhaps their have had enough with the endless govt interference.

The rich are, and always will be, rich.

Deal with it.

Or pretend that some day.

ALL the countries in the world will come to an agreement.

To implement a flat, fair , world wide, tax.

I wont hold my breath.

LikeLike