B.C. freezes salaries, bonuses for Crown executives, CBC News, July 25, 2012

“The B.C. government is freezing the compensation paid to executives at its Crown corporations, Finance Minister Kevin Falcon announced Wednesday morning.”

Well, Kevin, maybe it did not.

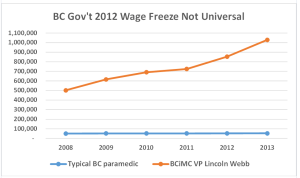

I haven’t gone through BCiMC’s 2013 financials in detail but amazing information about executive compensation jumped out. The remuneration of the investment management corporation’s five top executives jumped 50% between fiscal 2011 and fiscal 2013. (A commenter below correctly notes that return on investments declined significantly from 2011 to 2013. The corporate officers’ take during the year ended March 31, 2013 was up 29%. Imagine if executive compensation levels had not been frozen.

Between 2008 and 2013, compensation of five senior BCiMC executives (they make no reports on salaries for eight additional vice-presidents) rose from an average of $50,000 per month to an average of $83,000 per month. Lincoln Webb, one of twelve VPs, had his remuneration increase from $42,000 a month in 2008 to $86,000 a month in 2013. This does not include expenses or remuneration Webb draws from organizations outside BCiMC.

According to PEI Media, Webb serves,

“on the boards of Open Grid Europe, the Corix Group of companies, and Thames Water Utilities Limited, Britain’s largest water and wastewater company. He is also a past director of Puget Energy in Washington State, DBCT Ports of Australia, Transelec S.A., Chile’s largest transmission utility, and Aquarian Water of Connecticut In addition to these past and present positions Lincoln is also an advisory committee member to a number of private equity funds including Advent International, TPG Asia, and Cinven, a leading European-based private equity manager.”

He is a non executive director of Thames Water Utilities, the company that rewarded its CEO with a 2012 bonus of almost $700,000 despite “overseeing a drop in profits and ‘deteriorating’ satisfaction rates among its customers.” According to The Guardian in June 2013,

“The UK’s largest water company is accused of “ripping off the taxpayer” after revealing it paid no corporation tax and pocketed a £5m credit from the Treasury in a year when it made £550m in profit.”

The driving force behind rapidly escalating remuneration for senior officers is this. They collectively hold hands while playing a figurative game of leapfrog. There is almost no one willing to say no, because, if they do, they’ll no longer be welcome in the game.

Of course, the austerity discipline was applied a little more strictly for public servants not earning six and seven figure incomes.

The financial statements of BCiMC, audited by KPMP LLP, are not as revealing as they would be if accounting gibberish were eliminated. For example, read this statement from Note 3, Significant Accounting Policies, and then consider what new information you gain :

“The Corporation provides a retention incentive to employees in senior staff positions through a long-term incentive plan (LTIP). Eligible staff are entitled to their first LTIP payment in their fourth year of employment with the Corporation. LTIP is accrued for eligible employees at an amount equal to one quarter of the estimated aggregate pay-out for the current year and each of the following three years. The estimated payments for years beyond the next fiscal year are recorded as a long-term liability.”

The following was first published in November 2012. All information gathered from official reports of the BC Investment Management Corporation. You’ll find much more about BCiMC HERE.

I’ve been comparing the British Columbia Investment Management Corporation to the Washington State Investment Board. They’re very similar in terms of purpose and goals. Here are a few key stats:

bcIMC

- managed $92 billion as of March 31, 2012;

- earned a return of 10.8% in fiscal 2011;

- paid top five executives $4.1 million in year ended March 2012;

- employed 175 people at a cost of $36.1 million;

- pays (the Jawl Family) about $110,000 a month in office rent.

WSIB

- managed $85 billion as of March 31, 2012;

- earned a return of 21.1% in fiscal 2011;

- paid top five executives $1.2 million in year ended December 2011;

- employed 79 people at a cost of $9.5 million;

- pays about $20,000 a month in office rent.

Management of public pension fund investments is a lucrative situation in British Columbia but the direct financial cost of doing business is only part of the equation used to evaluate work of financial managers in the public sector.

A while back Swiss research firm Covalence released a ranking of twelve corporations rated worst in ethical performance among multinationals. I wondered if bcIMC was supporting any of those companies. Turns out, they were; all twelve of them. Our public pension plans have more than $1 billion dollars invested with the worst companies in the world.

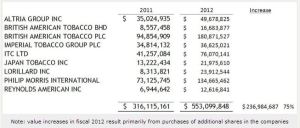

I previously noted that bcIMC is a substantial Enbridge investor ($657 million) and holds major positions in the world’s nine largest tobacco sellers ($553 million). Today, I checked bcIMC’s investments in arms dealers and determined they have spread over half a billion dollars among almost every one of the top 20 public companies involved in the international arms trade.

|

| BCiMC investments in tobacco companies, including those BC gov’t is suing to recover medical damages. |

This is not a crown corporation in which I have any pride.

Categories: BC Investment, Ethics

The Military Industrial Complex, not really “ethical investing”.

LikeLike

Question: “how much money has bcIMC lent to SNC lavilin, if any?

LikeLike

Ethical behaviour? In this government?!? You must be dreaming.

LikeLike

I agree that as a former teacher I would like to see our pension funds and those of municipal and other government workers used to create jobs in Canada and primarily British Columbia and that we with draw our funds from unethical companies such as all tobacco companies, all arms and munitions companies and most oil companies. Oil is a difficult one as in British Columbia most of our oil is primarily from the tar sands and we must find cleaner methods of producing the oil, minimizing its use and seek out alternative energy sources. Find ethical mutual fund managers is difficult as I have had difficulty and continue to have difficulties finding funds that are truly ethical as they are bought and sold and the managers and owner of the funds change.

LikeLike

Against this backdrop of largesse, many paramedics, including $2.00 hour part-time paramedics are not being paid because of a new payroll system:

http://www.castanet.net/news/BC/95616/Paramedics-claim-they-are-not-being-paid

LikeLike

I went to the BCiMC website to look at the most recent inventory of investments. The most recent one is 16 months old. I guess you embarrassed them Norm by giving us too much detail of the unethical companies our pension money supports.

LikeLike

You point out that five senior executives had their compensation rise by 50% between 2011 and 2013. It's interesting to note that the pension funds' returns on investment declined by 1.3% during that same period.

LikeLike

About $73 million invested in SNC Lavalin at March 31, 2012. No detail available for 2013.

LikeLike

You beat me to the punch, SNC Lavalin. Canada's answer to Halliburton….

LikeLike

Thanks Norm. The silence of the politicos in the Municipal Finance Authority to this type of grift is astounding. They authorize hundreds of millions in borrowings on our behalf yet have no opinion on the global financial cesspool from which they borrow. Talk about piano players in a whorehouse! Dave Barrett Weeps!

LikeLike

This comment has been removed by the author.

LikeLike

In addition to paying millions for in-house expertise, according to audited financial statements, BCiMC pays millions more to outside consultants and more millions to contracted systems people.

Here is another shocking revelation: minimum lease payments based on current and new lease agreements amounted to $4 million in fiscal 2012. In 2013, that obligation rose to $31 million.

Strange happenings at BCiMC, facilitated by a grouop of Directors who also dip deeply into the honey pot.

LikeLike

Depressing, Norm.

I'm going to send a link to my MLA.

LikeLike

Quick response from my MLA, John Martin, within 30 minutes of receipt: “Thank you for raising this matter Barry; I will look into it. Hope you're enjoying your summer.

best”

LikeLike

Thanks Barry. Other people ought to do the same. Ask your MLA if they approve of this operation.

LikeLike

First, Washington State uses more external private fund managers, which costs their pension plans millions more. Why not look at total costs rather than only internal cost of the organizations? Second, are they invested in similar asset classes and do they have similar strategies? If not, you are comparing apples and oranges as there are enormous differences in due diligence and costs among different asset classes. Third, much of the compensation is based on results over the past 4 years. Have the organizations had similar value added? Finally, what are the long-term returns of both organizations after costs? That might yield something meaningful rather than a superficial comparison of internal costs. By the way, have you looked at other pensions that manage most of the funds internally? You should compare bcIMC salaries and costs to Ontario Teachers' Pension Plan or the Canada Pension Plan.

LikeLike

The comparisons I make are and should be embarrassing to the BC Liberals and the so-called overseers on BCiMC`s board. Why don`t you explain how current and new lease obligations rose from $4 million to $31 million in the most recent fiscal year.

Explain how WSIB paid its CEO, executive director Teresa Whitmarsh, $248,316 in the last fiscal year, down $320 a month from the preceding one, while BCiMC paid its CEO, Doug Pearce, $1,260,943, up $16,460 a month.

The amount BCiMC paid its five top paid staff, was equivalent to the amount WSIB paid its 35 top paid people in the last fiscal year.

I would certainly be willing to review additional detail of how BCiMC spends its money but it is not available. They provide summary financial statements but those are intended to meet minimum standards, not to inform readers or enable researchers to conduct full reviews.

If BCiMC wants to defend itself, it needs to provide real information not endless puffery and outdated information.

For example, the inventory of investments available to the public is 16 months out of date. The organization does not behave like one that values transparency and accountability.

LikeLike

It manages a $100 billion. I assume the auditors look at the legitimacy of such office expenses. Maybe they are bringing more assets in house to reduce costs.

Here is a link to a blog written by someone who understands pensions and pension management. Quite a few past blogs on bcIMC including discussions on exec compensation.

http://pensionpulse.blogspot.ca/2013/07/bcimc-gains-95-net-in-2012-2013.html

LikeLike

WSIB manages a comparably large fund and no, KPMG does not report anything to the public about appropriateness of expenditures or value for money. They may do so in management reports but, of course, those are not made available to the public. I suspect the lease obligations relate to real estate. Their primary landlord did a sweet deal with BC Ferries, which lent the Jawls $25 million on a second mortgage. Wonder if that name comes up in BCiMC lease agreements.

LikeLike

That is the purpose of the auditor, so you can trust the statement without all the detail…

If you do blog search on the above link, you will learn a lot more about bcIMC and understand why we do not want our public sector plans to emulate their US counterparts. A past blog also noted that bcIMC was exempted from the freeze.

bye-bye

(PS They manage my pension and I am happy for it.)

LikeLike

Have a look at Ontario Teachers' Pension Plan, AIMCO, CPPIB, OMERS, and PSP before you talk about BCIMC's salaries. The CEO of Ontario Teachers got $5.4 million. BCIMC people provide great returns at a fraction of the cost of others!

LikeLike

Canada, especially government organizations are fast becoming depositories for friends of the government, to slurp at the public trough. Corruption is endemic in Canada and especially BC and the BC Liberals under Gordo ensured this legacy would continue and with gusto.

The voter has been mesmerized by an equally corrupt mainstream media, which is now the propaganda arm of the corrupted BC Liberals and are at their beck and call. I'm afraid that corruption and corrupt practices are so entrenched in BC, we will never be clean, instead sink ever deeper into the morass of corruption, malfeasance organized crime and the rest of the harbingers of hell.

LikeLike

I wonder if BC Ferries lent the 25 million to Jawl Properties before the building was completed and the first mortgage in place. Did they agree to always stay in 2nd position, even if Jawl wanted to refinance?If the money was advanced before the building was complete, it would have been construction financing, which is typically high very costly.

I am surprised that media and opposition politicians haven't gained the full story on this one. It does seem that Jawl Properties got very special treatment.

LikeLike

Just another fine example of how you have to attract the best and the brightest.

LikeLike

I have just sent a link to my MLA also.

LikeLike