“Curiouser and curiouser!” Cried Alice.

Alice’s creator, English writer Lewis Carroll, penned the title words in 1865. Carroll, born Charles Dodgson, was an Oxford trained mathematician. Were he a 21st century resident of British Columbia, Carroll might be using that phrase about BC Hydro deals with SNC-Lavalin.

Particularly the deal involving the John Hart dam and power station near Campbell River.

I wrote about this odd situation some years ago, in an article titled Curious deal in BC’s pay-to-play economy:

In the last holiday season, while few journalists were paying attention, a new chapter emerged in the weird mix of public and private power in British Columbia. BC Hydro announced upgrades to the John Hart dam near Campbell River. The project is estimated to cost up to $822 million. Given the utility’s history of inaccurate budgeting, that number might double.

I surmise this is another situation where private companies profit more than they should and the public pays more than it should. But exact details are hidden. As is common with public private partnerships, the public knows little more than the cash outflows can be staggering.

This listing does not include all public payments benefiting the Quebec based company that is so popular with politicians and senior civil servants across the country. One example is PROTRANS BC, a subsidiary of SNC-Lavalin Inc. that is the private operator of the Canada Line,

SNC-Lavalin tells investors its affiliate InPower BC is highly profitable. BC Hydro supposedly believes the arrangement for this relatively small Vancouver Island facility is appropriate. But having entered into a long term deal to pay In-Power, BC Hydro now will spend a huge sum to rebuild the dam that serves In-Power’s John Hart Power Station. SNC-Lavalin will collect major fees for this new construction project, as it does on other BC megaprojects.

In other private power arrangements made with BC Hydro, initial, politically connected contractors flipped the deals for quick wins. According to business media, SNC-Lavalin sold 80% of InPower BC even before it was fully operational:

SNC-Lavalin holds a 20% interest in InPower BC, which was launched in 2017. The initial closing of the first four assets took place on September 27, 2017, and the transfer of a fifth asset was completed on June 28, 2018.

Were BC Hydro operated for the benefit of citizens and ratepayers, it would seek out the lowest cost supplies of electricity. Because it is not, we get deals for the most expensive power produced anywhere.

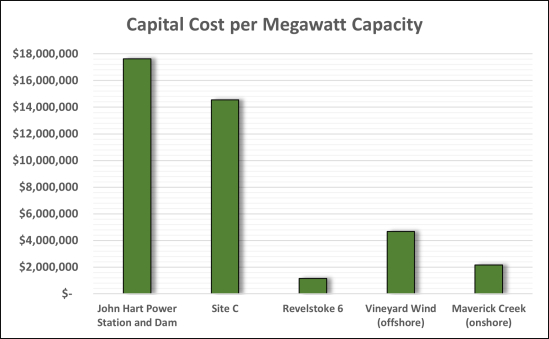

Horgan’s BC NDP presented an appealing energy policy to the public before taking power in 2017. Note paragraph 3 where they spoke of Revelstoke Unit 6. Forty-five percent of the capacity of Site C for three percent of the cost. In the end, that spending efficiency did not appeal to empire builders enjoying high priced employment at BC Hydro.

At 138 MW, the John Hart generating capacity is one-eighth the capacity of Site C. In 2003, BC Hydro estimated a new John Hart powerhouse would cost $210 million ($271 million in 2018 dollars). When completed, it was said to be a $1.093 billion project, which is four times the original estimate.

If the $822 million estimate for a new John Hart dam increases by only 50%, the capital cost per megawatt of capacity of the Campbell River facility would be extraordinary.

Categories: BC Hydro

Hi Norm; When it comes to recklessly spending money, BC Hydro is right up there because they know the population will pay what ever.

Last year the new Auditor General announced that accounting rules would be changing the coming March. Do you have any idea of what is in store or even if the AG will still be able to follow through?

I hope everyone connects dots between signing contracts and/or borrowing by selling bonds and the loss of sovereignty.

LikeLike

you forgot burrard thermal?

LikeLike

The new leader of BC Liberals says the current government has no big projects. Compared to Site C he is right. The people of BC will be paying high hydro rates for years to cover these white elephants. Oh well what’s another 21 billion in debt plus interest? Mr. Falcon hopes to further enrich his friends (and Trudeau’s) at SNC Lavalin.What a scumbag !!

LikeLike

“MONTREAL, Feb. 7, 2022 /CNW/ – SNC-Lavalin (TSX: SNC), a fully integrated professional services and project management company with offices around the world, has announced today that it has finalized the transfer of a sixth public-private partnership (P3) asset, the InPower BC General Partnership, to the SNC-Lavalin Infrastructure Partners LP (the “Partnership”) for a total cash consideration of approximately $41 million for SNC-Lavalin.”

https://www.newswire.ca/news-releases/snc-lavalin-completes-the-transfer-of-sixth-canadian-asset-into-its-infrastructure-investment-vehicle-884931170.html

“BBGI Global Infrastructure S.A., the global infrastructure investment company is pleased to announce it has completed an investment in InPower BC General Partnership, the entity responsible for delivering the John Hart Generating Station Replacement Project (“John Hart Generating Station), an investment made through the existing strategic partnership between the Company and SNC-Lavalin Group Inc…”

“BBGI’s investment is approximately CAD 41 million…”

https://tools.eurolandir.com/tools/Pressreleases/GetPressRelease/?ID=4039950&lang=en-GB&companycode=lu-bbgi&v=

That sound you just heard was your indebtedness changing hands. And you have no say in it.

Under a banner promising “Low-risk investment Long-term returns”, BBGI Global Infrastructure S.A. advertises on its website that:

“We are a global infrastructure investment company helping to provide the responsible capital required to build and maintain the developed world’s transport and social infrastructure.”

“We follow a low-risk, globally diversified and internally managed investment strategy to deliver long-term, predictable returns to our shareholders. We target an internal rate of return (IRR) in the region of 7 to 8 per cent on the IPO issue price of 100 pence per ordinary share.”

Listed in its North American asset portfolio as providing these low-risk, long-term returns are some entities familiar to British Columbians.

Canada Line – “Availability payments are received from Translink, a highly rated government entity responsible for transportation in the Greater Vancouver Regional District.”

Golden Ears Bridge – “Through its management of the project company, BBGI has developed relevant experience managing contractors in the delivery of complex contracts and coordinating with multiple stakeholders. The Golden Ears Bridge represented the largest private financing for a greenfield PPP in Canada at the time and was procured by TransLink together with Partnerships BC.”

William R. Bennett Bridge – “The project became operational in 2008 and receives availability payments from the Province of British Columbia.”

Kicking Horse Pass – “The project has been operational since 2007. Availability payments are received from the Province of British Columbia.”

If what’s past is prologue it’s just a matter of time until BBGI Global Infrastructure S.A. will be listing availability payments from a new hydro dam as an asset far into the future. Good for them and everyone on the private side from project cradle to grave. Somehow I’m not convinced it’s nearly as good for the public side of the partnership.

Think of a nice fluffy sheep standing on the shearing table as a partner in the wool business.

LikeLike

Or the sheep lined up at the slaughter house as a partner in the meat industry!

LikeLike