Times might be tough for many in British Columbia, but executives managing public pension funds are doing okay. Even better than okay.

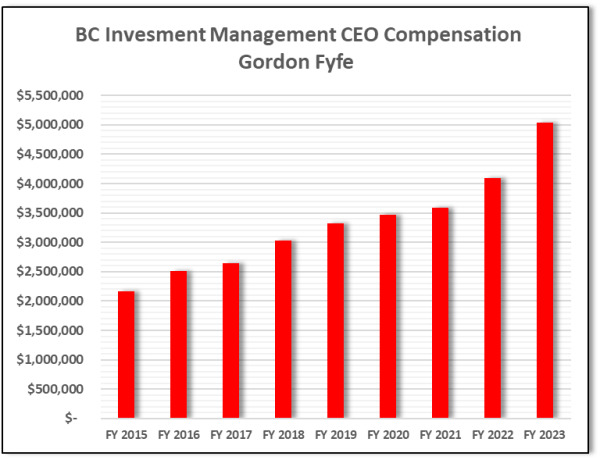

The British Columbia Investment Management Corporation (BCi) looks after public pension funds. It is the most rewarding place to work in BC’s public sector. Most rewarded is CEO Gordon Fyfe. According to the 2023 Annual Report, he scored a single-year raise of $947,146. That was better than his measly $510,589 raise in the previous year.

Three of Fyfe’s associates enjoyed raises of more than $1 million according to the 2023 Annual Report.

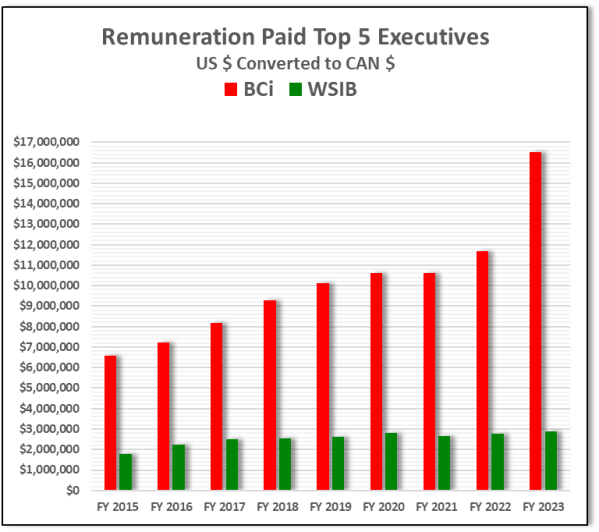

Executives investing public pensions funds for our neighbours in Washington State may have comparable duties, but their salaries are a fraction of executive payments in BC.

BCi’s March 31, 2023 Annual Report shows its top five executives were paid a total of C$16,527,011, up $4,842,987 from the year before. WSIB’s top five earned C$2,212,400 in 2022, up only $C2,212 from the previous year..

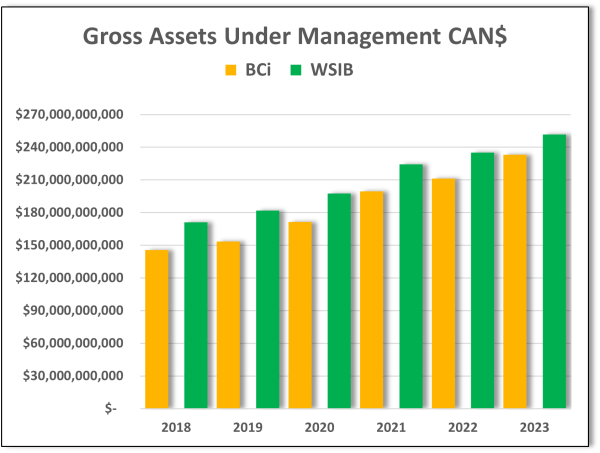

Washington State Investment Board is similar to BCi. The American group managed $C237 billion according to its 2022 Annual Report, while BCi was managing C$233 billion as of March 2023.

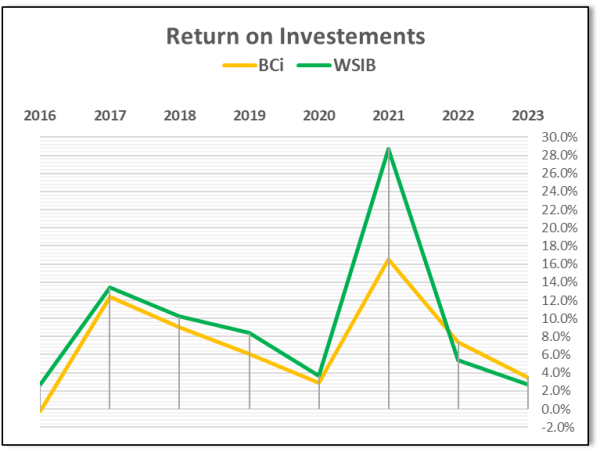

You’re probably expecting the highly paid group gained far better returns than their counterparts to the south. Not quite. The Washington State Investment Board has often posted better results on its investments. In 2022, their Commingled Trust Fund (CTF) posted performance of 5.4 percent. In 2021, the return was 28.7 percent.

For the fiscal year ended March 31,2023, BCi posted returns of 3.5 percent. In fiscal year 2022, the return on British Columbia pension funds was 7.4 percent.

I have reported on similar disparities many times before, but few people seem to care. Years ago, a report in The Sunday Times may have explained the disinterest:

Pension fund members are almost universally detached from the management of their money and, when they do try to discover more, they find fund managers unaccountable and institutions opaque,

Oversight of BCi management is done by the Board of Directors. But membership on the Board is not maintained by rocking the boat, and staying on the Board is financially rewarding.

Directors’ annual retainers range from $18,350 to $36,700. Per diems are close to $1,000 a day and these are paid whether a director attends a four hour in-person Board or committee meeting, or a 5 minute online or telephone discussion. In addition, BCi pays for memberships and expenses for conferences.

Categories: BC Investment

Thanks for keeping watch on this outfit. As a member of the public service pension plan, it’s dismaying to see this nest-feathering going unchallenged.

Meanwhile, BCI has shown rather unimpressive performance on the climate front: https://www.shiftaction.ca/news/bci-2022-annual-report

Where are the public sector unions?

LikeLike

Thanks for this important information. I feel shamefully lacking in knowledge about my own Teachers Pension as well as CPP. And a complicity by default in just what our plans are invested in – namely the oil and gas sector.

LikeLike

At the risk of being viewed as lazy, I’ll just cut and paste one of my previous comments to Norm’s excellent reminders of this continuing travesty. This one from 2018.

“I wrote this in comments to Norm’s previous excellent work on this issue. It seems that the last paragraph may have been accurate. ‘My wife receives a pension from the fund managed by this bunch. She received a notice of changes this summer that will cost us around $1,000 a year. Strangely, the notice did not include any fulsome explanation of why the changes might be necessary. With people like the CFO of Finning chairing the bcIMC Board that appointed Fyfe, and an executive vice-president and CFO of BC Hydro chairing the Board’s audit committee, one would think the talent should be there to be candid with the pensioners kneecapped in this manner. While we’re thinking of the unexplained, here’s a chin-scratcher for you. Gordon Fyfe came to the bcIMC straight from his gig as CEO of the Public Sector Investment Board in Ottawa. According to page 65 of the 2014 annual report of that organization, his compensation for the years 2014, 2013, and 2012 was $4,206,983, $5,307,541, and $3,404,746 respectively. http://publications.gc.ca/collections/collection_2014/investpsp/CC511-2014-eng.pdf Now, he was born in Victoria and according to his bio still has extended family there, which might make a return attractive. He does bear a striking resemblance to one Richard Fyfe, the author of the Basi/Virk payoff agreement we all know and love from the BC Rail trial. But is that and a nice waterfront office enough to take a $2,000,000 pay cut to leave Ottawa? Or is the raise he got in his second year here a sign of much bigger rewards ahead? Time will tell. But don’t look to the MSM for details. Come back to Norm’s for those.’ https://in-sights.ca/2016/08/20/disvalue-for-money/ “

Once again, the last paragraph remains accurate. Some things never change.

And remember, it is the public sector union members who are ultimately responsible for this.

LikeLike