People in BC will unfairly pay the full carbon tax while the oil and gas industry—whose production is responsible for more than 25% of BC carbon emissions—will get a carbon tax break.

That’s a key takeaway from a report by Marc Lee, Senior Economist at the Canadian Centre For Policy Alternatives – BC Office.

- As homeowners and small businesses pay increased carbon tax, large industrial players—including the oil and gas industry that is causing climate change—have steadily evaded their carbon tax.

- The BC NDP introduced a system to exempt a portion of producers’ oil and gas emissions from taxation to maintain competitiveness with production in regions outside BC.

Why we should be concerned about the competitiveness of the oil and gas industry, whose business model involves overheating the planet, is never discussed.

- Beyond exemptions, loopholes called “compliance mechanisms” reduce industrial emissions. Some of these involve carbon offset projects that are a license to pollute. Many offset projects have proven to be a form of greenwashing.

Indeed, they dovetail with a recent story in the National Post about a former NDP staffer working for TC Energy bragging about the company’s “influence tactics” with senior BC civil servants. According to the Post, “the company’s efforts “dramatically” influenced BC’s carbon-tax rate adjustment in February 2023 and ultimately halved the operation costs of the province’s carbon tax on its projects.”

In my home, we reduced natural gas consumption by 30 percent in 2023, compared to 2016, the year before BC NDP formed the provincial government. But the amount of carbon tax we paid to heat our home increased by 60 percent.

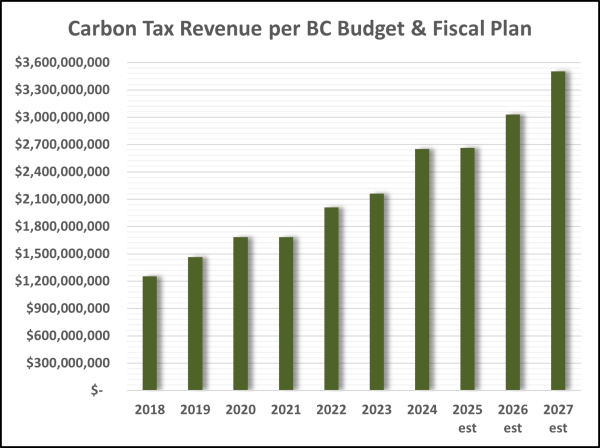

Carbon tax has undoubtedly become an important source of provincial revenue.

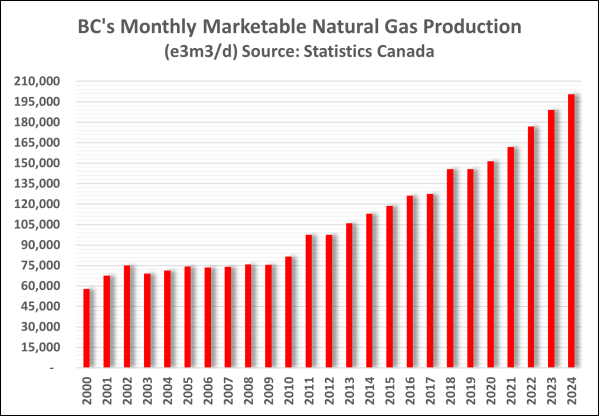

So BC taxpayers currently paying close to $3 billion a year in carbon tax must result in lower production of natural gas, right? Maybe not.

Categories: Climate Change, NDP BC, Taxation

Thank you for reminding me of the carbon tax break the oil and gas industry gets. I would like to know how much less they are paying vs Mr & Mrs Homeowner.

Also, to be fair, while the province collects almost $3 billion/year in carbon tax a good percentage of it is returned to citizens as a rebate (means tested).

LikeLike

I have not been able to find irrefutable evidence showing how much of the carbon tax is returned to individual taxpayers. I can find press releases, but they are not reliable evidence.

LikeLike

The carbon tax has helped to reduce consumption of Canadian natural gas in Canada. It has allowed the export of the saved gas to other parts of the planet, because those parts of the planet have a different atmosphere from Canada, and it’s okay for the green house gas emissions in that atmosphere to grow. I’m pretty sure that is what the NDP Cabinet believes anyway.

LikeLiked by 1 person

Quote: “because those parts of the planet have a different atmosphere from Canada, and it’s okay for the green house gas emissions in that atmosphere to grow. I’m pretty sure that is what the NDP Cabinet believes anyway.”

A different atmosphere than Canada, f***ing really? What do they breathe, methane?

If that is what the NDP believe, god help us.

LikeLike

The Carbon tax was created in BC as a revenue generator to offset the large tax reductions for the wealthy and continues as a placebo for government to pretend it is doing something, when it is not.

So let’s look at what the carbon tax could do.

Let us look at the the carbon tax revenue for 2024, 2025, 2026 which would be estimated at $8 billion dollars.

For $8 billion we could build a Vancouver to Chilliwack regional railway using the former BC Electric route – $1.6 billion

Restore the E&N to a modern regional railway serving Victoria to Courteny – $3 billion.

Restore a Salmon Arm to Kelowna regional railway – $2 billion

So, the projects that would, by their very nature, take cars off the road, but no, the NDP is spending over $2 billion to widen HWY1 to Chillwack, adding more cars.

The carbon tax is a massive revenue generator, creating a massive slush fund for the NDP at election time, especially for BC’s famous or infamous “blacktop politics”.

LikeLike

is BC Hydro using carbon tax to fund billions in sw bc upgrades?

LikeLike