In the 1960’s, tax expert Kenneth Carter headed a Royal Commission that examined Canada’s income tax system. Among many other things, Carter’s group was asked to report on “changes that may be made to achieve greater clarity, simplicity and effectiveness in the tax laws and their administration.”

When material changes were implemented in the Income Tax Act, I was a young person working in public accounting. We laughed at the idea that government and its consultants — typically lawyers and accountants — aimed to simplify tax laws. After changes made following the Carter Commission, many taxpayers needed professional accountants more than they ever did.

But we didn’t blame the Carter Commission. While some of their recommendations were adopted, important ones were filtered, twisted, amended, or ignored. Writing in a 1988 edition of the Osgoode Hall Law Journal, Robert Couzin said tax law complexity resulted from “convoluted drafting: fuzzy, illogical, and inconsistent concepts and poor administrative organization.”

Carter was interested in fairness and said government should make greater use of the Tax Act to improve equity:

The opportunities inherent in the fiscal system for redistributing purchasing power among people to achieve a social purpose are overlooked; and in concentrating on the effect of taxation on individuals the profound implications of the tax system for the economy and for society tend to be neglected.

The Carter Commission wrote:

We believe that four fundamental objectives on which the Canadian people agree are:

- To maximize the current and future output of goods and services desired by Canadians.

- To ensure that this flow of goods and services is distributed equitably among individuals or groups.

- To protect the liberties and rights of individuals through the preservation of representative, responsible government and maintenance of the rule of law.

- To maintain and strengthen the Canadian federation.

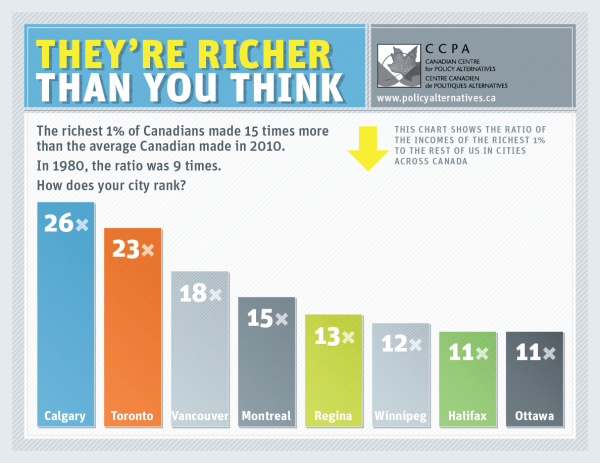

The Commission recommended abolition of tax privileges gained by wealthy citizens. But those people strongly resisted the Carter assertion that “a buck is a buck is a buck” whether it came from wages or investment activities. They used their outsized political influence to keep governments from implementing basic elements of the Royal Commission’s report.

People who influenced public policy believed that focusing wealth in the hands of a few — their own hands in particular — was good for business. They argued that wealth concentration encourages investment, economic growth, and job creation. Of course, it also encourages consumption of luxury goods like superyachts, private jets, multi-million dollar art pieces, space travel, etc.

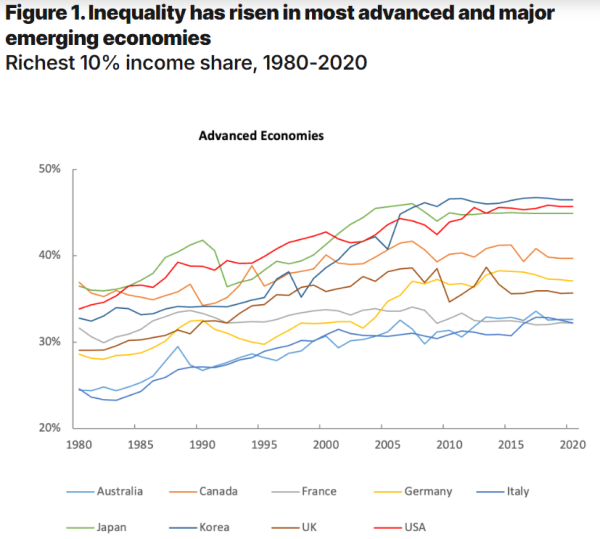

Over the past four decades, there has been a broad trend of rising income inequality across countries. Income inequality has risen in most advanced economies and major emerging economies, which together account for about two-thirds of the world’s population and 85 percent of global GDP.

Brookings Institute —Rising inequality: A major issue of our time

The rationale behind progressive taxation is based on the idea of ability to pay. People with higher incomes can pay a larger proportion of their income in taxes without sacrificing basic needs. This can moderate economic inequality and more funds would be available for healthcare, education, public infrastructure and social safety nets.

A tax system is not progressive if high-wealth individuals use overseas tax shelters, exploit loopholes, and employ “charitable” foundations, complex trusts, and corporate structures to avoid or evade taxes. American tax laws are even more tilted in favour of the super-rich. Billionaire Warren Buffett, said that his effective tax rate was lower than that of his secretary.

The collective fortune of America’s 806 billionaires hit a record $5.8 trillion, according to figures collected on April 1, 2024, by Americans for Tax Fairness (ATF) for its latest report on billionaire wealth growth based on Forbes data. Billionaire wealth has nearly doubled—up $2.9 trillion—since enactment in late 2017 of the Trump-GOP tax law. Under current rules, none of that nearly $3 trillion in wealth gain–the main form of income for the ultra-wealthy–may ever be taxed.

The richest 1 percent have amassed $42 trillion in new wealth over the past decade, nearly 34 times more than the entire bottom 50 percent of the world’s population, according to new analysis by Oxfam.

A new Canadian Royal Commission on taxation, like the comprehensive one begun by Carter et al in 1962, would be useful to academics and people interested in fairness. But there would likely be no material changes in tax laws and enforcement. As in Carter’s time 60 or so years ago, influential citizens today want the unfair system to continue. So it will.

Here at advertising-free IN-SIGHTS, followers are not asked to subscribe, but volunteer financial support from readers enables the site to continue. If you find value in the content here, please make a contribution. Methods are described HERE.

Categories: Tax Evasion & Avoidance, Taxation

An income tax overhaul that results in greater equality is long overdue. In fact there is overwhelming support for it. In the United States 70% of people support raising taxes on the wealthy. Also, a majority of Canadians believe wealth inequality should be tackled by increasing taxes on the wealthy and large corporations and even said it could influence their vote, according to a new poll. (National Observer, Aug 5/21). Poll results below.

https://abacusdata.ca/tax-fairness-canada-poll/

I’ve been encouraging the BC Green party to develop an election plank that overhauls the BC Income Tax structure resulting in a sizeable tax break for lower and middle income earners and higher tax owing for high income earners. If any of your readers agree with this plank idea I would encourage them to email the BC Greens stressing their support. We need to bring in policy that reverses the growth of wealth inequality.

It should also be pointed out that the top marginal tax rates were much higher prior to the 1980s.

LikeLike