BC Policy Solutions is a British Columbia-based charitable think tank that went public in 2025. It focuses on researching the policy solutions available to British Columbia. It is a successor to the BC office of the Canadian Centre for Policy Alternatives and continues to produce high-quality work.

Senior Economist Alex Hemingway authored This is why BC’s housing crisis hasn’t been solved yet. Hemingway agrees that public ownership or support is critical to changing the current situation.

The magnitude of the housing shortage is huge, the problems chronic, but the housing crisis is solvable.

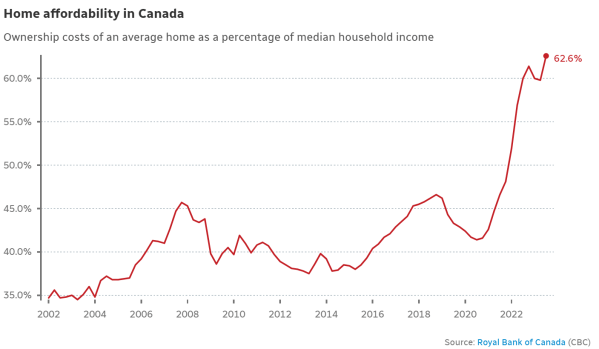

Throughout the province and country, the housing crisis is marked by high rents and prices, a scarcity of homes, displacement, homelessness and the quiet exclusion of people from entire neighbourhoods.

While a boon to some, high housing costs are a millstone weighing on many households, a drag on the economy and a barrier to progress in a range of other policy areas including poverty, affordability, climate action and child care…

…the market alone cannot solve the housing crisis. It is essential to significantly increase public investment in non-market housing to meet the needs of the people worst affected by the housing crisis…

For decades, Canada has underinvested in public, non-profit and co-op housing.

The result is that today only about 3.5% of the country’s housing stock is social housing, which is half the OECD average…

The federal government did once invest substantially in social housing—building roughly 16,000 new units per year in the 1970s and 80s—but funding cuts in the 1990s saw that wither. And the provinces—including BC—did not fill the gap.

The consequences: wait-lists for social housing have grown rapidly and homelessness has proliferated in one of the world’s richest countries. Failing to ensure people can meet their housing needs comes at enormous social and economic costs…

Hemingway states that building more units and addressing scarcity will cause prices to fall. Generation Squeeze says instead of more supply, we need the right supply. I agree with the latter.

‘Right supply’ means building homes that – in location, form, tenure and price – better suit the needs of existing and aspiring residents.

With commodification of housing in Canada, homes are treated as investment assets, not just shelter. Investor-led speculation has led to soaring prices, rental increases, and rising homelessness. Housing has been turned into a wealth-extraction tool, impacting low-income families and essential workers most severely.

Categories: Housing, Uncategorized

One thing I think people forget is – it became a good idea to invest in real estate as an investment when interest rates dropped substantially. Those with money that needed to be invested so that at some point they could retire, moved from earning interest at a bank to buying condos and renting them out. Low interest rates drove investors into the market — not just because in theory the cost to buy was lower (it wasn’t really, people jacked up the price of their homes to sell), but that earned savings needed to increase in value, and real estate was how to do it.

LikeLike

You mention investing. Anybody remember Canada Savings Bonds?

Seventy years ago it offered people worried about becoming destitute pensioners a way to benefit from “investing in Canada”.

Why ask? Who owns Japan’s debt? The Japanese public and the Bank of Japan. In due course the Japanese public will receive benefits for “investing in Japan”. A crucial difference between Canada and Japan? Their debt stays in Japan.

https://www.canada.ca/en/treasury-board-secretariat/services/pension-plan/news-notices-pensions- benefits/end-canada-saving-bonds-program.html

“End of the Canada Savings Bonds Program”

“In the latest federal budget released on 22 March 2017, the Government of Canada announced it will discontinue the sale of Canada Savings Bonds (CSB) and Canada Premium Bonds (CPB) as of November 2017.”

“A formal communication was sent out to all Payroll Savings Plan owners and contributors from the Canada Savings Bonds Program, on behalf of the Government of Canada.”

“Your CSB contributions will continue to be deducted from your monthly pension until October 2017.”

“The funds (principal and interest) in your Payroll Savings Plan are safe, guaranteed and will be honoured. Bond series in your plan will continue to earn interest until redemption or maturity, whichever comes first. Go to CSB Online Services to validate your mailing address or sign up for direct deposit to ensure you receive your payment.”

“To find out what this announcement means to bond owners, you are encouraged to refer to the “Questions and Answers” by visiting the Canada Savings Bonds Program’s website.”

https://hellosafe.ca/en/investing/canada-savings-bonds.

“How do savings bonds work?”

“Bonds work as an I.O.U. between an investor and a borrower, like a federal government, local government, or a company. The borrower often issues them to fund a new project or to refinance debt. High-quality bonds such as those from the U.S. government, or the former bonds by the Government of Canada generally have relatively low interest rates because they are considered a guaranteed investment. Less certain bonds, such as those from some companies or less-stable governments, offer higher interest rates in exchange for that higher risk.”

“Canada Savings Bonds had 9 main features:

“The minimum purchase amount of a Canada Savings Bond was $100.”

“There were no fees to buy a savings bond.”

“The term of a savings bond was three years”

“The interest rate of the savings bond was usually set at the time of purchase”

“The interest rate on the bond could not decrease over time, however, it could increase.”

“Savings bonds could be held in certain registered accounts such as an RRSP, TFSA or RRIF.”

“The employer could act as an intermediary between the purchaser and the Canadian government if it offered a payroll savings program.”

“Canada Premium Bonds (CPBs) could be redeemed at any time. However, only the interest earned up to the anniversary date of the issue could be collected.”

“Canada Savings Bonds (CSBs) have a lower interest rate than Canada Premium Bonds (CPBs).”

https://www.investopedia.com/terms/j/jgb.asp

“Japanese Government Bonds (JGBs) vs. U.S. Treasuries”

“Japanese government bonds (JGBs) are very much like U.S. Treasury securities. They are fully backed by the Japanese government, making them a very popular investment among low-risk investors and a useful investment among high-risk investors as a way to balance the risk factor of their portfolios. Like U.S. savings bonds, they have high levels of credit and liquidity, which further adds to their popularity. Furthermore, the price and yield at which JGBs trade is used as a benchmark against which other, riskier debt in the country is valued.”

Who owns Canada’s debt?

https://www.theaudit.ca/p/who-owns-canadas-public-debt

“How much money does Canada currently owe? According to Statistics Canada’s statement of government operations and balance sheet, as of Q4 2024, that number would be nearly $954 billion. That’s compared with the $621 billion we owed back in 2015.”

“How much does interest on our current debt cost us each year? The official Budget 2024 document predicted that we’d pay around $51 billion each year to just service our debt. But that’s before piling on the new $225 billion.”

“We – and the governments we elect – might be tempted to imagine that the cash behind public loans just magically appears out of thin air. In fact, most Canadian government debt is financed through debt securities such as marketable bonds, treasury bills, and foreign currency debt instruments. And those bonds and bills are owned by buyers.”

“Who are those buyers? Many of them are probably Canadian banks and other financial institutions. But as of February 2025, according to Statistics Canada, it was international portfolio investors who owned $527 billion of Canadian federal government debt securities.”

“Most of those foreign investors are probably from (relatively) friendly countries like the U.S. and U.K. But that’s certainly not the whole story. Although I couldn’t find direct data breaking down the details, there are some broadly related investment income numbers that might be helpful.”

“Specifically, all foreign investments into both public and private entities in Canada in 2024 amounted to $219 billion dollars. In that same year, investments from “all other countries” totaled $51 billion. What Statistics Canada means by “all other countries” covers all countries besides the US, UK, EU, Japan, and the 38 OECD nations.”

“The elephant in the “all other countries” room has to be China.”

“So let’s break this down. The $527 billion foreign-owned investment debt I mentioned earlier represents around 55 percent of our total debt. (1) And if the “all other countries” ratio in general foreign investments holds true (2) for federal public debt, then it’s realistic to assume that the federal government currently owes around 11 percent of its debt to government and business entities associated with the Chinese Communist Party.”

Click to access federal-and-provincial-debt-interest-costs-for-canadians-2025.pdf

“In aggregate, the provinces and federal government are expected to spend $92.5 billion on interest payments in 2024/25. • Residents in Newfoundland & Labrador face by far the highest combined federal-provincial interest payments per person ($3,432). Manitoba is the next highest at $2,868 per person. • The federal government will spend a projected $53.8 billion on debt servicing charges in 2024/25, which is more than what the government expects to spend on the Canada Health Transfer ($52.1 billion), and significantly more than it expects to spend on childcare benefits ($35.1 billion). • Combined federal-provincial interest costs in Ontario ($36.2 billion), Quebec ($21.8 billion), and Alberta ($9.5 billion) are nearly as much, or more than, what these provinces expect to spend on K-12 education in 2024/25. • Meanwhile, combined federal-provincial interest costs for British Columbians ($11.8 billion) are higher than what the province expects to spend on its social services in 2024/25”

So? Every year Canada and the provinces must pay “investors” at least $92.5 billion. With Mr Carney’s budget adding another $225 billion that number will jump, permanently. As described in Ellen Brown’s 2012 article politicians will continue to react with the usual “solutions” to out of control Debt..

“Last week in Ottawa, the Canadian House of Commons passed the federal government’s latest round of budget cuts and austerity measures. Highlights included chopping 19,200 public sector jobs, cutting federal programs by $5.2 billion per year, and raising the retirement age for millions of Canadians from 65 to 67. The justification for the cuts was a massive federal debt that is now over C$ 581 billion, or 84% of GDP.”

LikeLike

Blair Fix at _Economics from the Top Down_ also wrote two very good papers on the converion of housing into a financial asset class:

From Commodity to Asset: The Truth Behind Rising House Prices

The American Housing Crisis: A Theft, Not a Shortage

LikeLike

Renewed interest in “interest”?

Albert Einstein is often quoted as saying that compound interest is “the most powerful force in the universe.” The quote is probably apocryphal, but it reflects a mathematical truth. Interest on earlier interest grows exponentially, outrunning the linear growth of revenue and eventually consuming everything.

That is where the United States now stands. The government does pay the interest on its debt every year, but it is having to pay it with borrowed money. The interest curve is rising exponentially, while the tax base is not.

Interest is now the fastest growing line item in the entire federal budget. The government paid $970 billion in net interest in FY2025, more than the Pentagon budget and rapidly closing in on Social Security. It already exceeds spending on Medicare and national defense and is second only to Social Security. The Congressional Budget Office projects that interest will reach nearly $1.8 trillion by 2035 and will cost taxpayers $13.8 trillion over the next decade. That is roughly what Social Security will pay out over the same decade (about $1.6 trillion a year). The Social Security Trust Fund is running dry, not because there are too many seniors, but because interest payments are consuming the federal budget that should be shoring it up.

See also

How a Fed Overhaul Could Eliminate the Federal Debt Crisis, Part II: Curbing Fed Independence

LikeLike

On the subject of Wealth Extraction…

Has BC Hydro Chair Mr. Clark studied info comparable to this video?

Should Hydro planners? Why not?

https://www.msn.com/en-us/news/us/why-america-can-t-build-clean-energy-and-who-s-really-stopping-it/vi-AA1RDnZ0?ocid=BingNewsSerp&cvid=116b7283da144471fb3d35516ee8160b&ei=36#details

Yes, it looks like competition to reduce US home heating costs (with help from President Biden’s Inflation Reduction Act) has reduced the cost of living by its support to replace fossil fuels. Many similar projects are on the rise.

Grounds for optimism unless you examine Exxon’s latest rosy forecast.

https://oilprice.com/Latest-Energy-News/World-News/ExxonMobil-Oil-Demand-Will-be-Over-100-Million-Bpd-in-2050.html

“As the rivalry over global oil demand projections continues to intensify, supergiant Exxon Mobil on Monday chimed in to forecast that crude demand will continue to be over 100 million barrels per day through 2050, contradicting other forecasts that come in much lower, Reuters reported.”

“The forecast from Exxon, which is planning to see output of 4.3 million barrels of oil and gas per day this year, is at odds with other forecasts, both among its peers and among analysts.”

“Exxon has also estimated that in 2050, 67% of the global energy mix will be fossil fuels, down from 68% last year.”

“Exxon’s full-year 2024 projected output represents 30% more than peer Chevron’s, according to Reuters, and the company’s demand projection is 25% greater than BP’s released in July, predicting that global oil demand will peak next year at around 102 million bpd, while wind and solar capacity will continue along their fast growth trajectory.”

[Is there anything comparable to President Biden’s Inflation Reduction Act anywhere in Canada? Should there be?]

https://bidenwhitehouse.archives.gov/briefing-room/statements-releases/2024/08/16/fact-sheet-two-years-in-the-inflation-reduction-act-is-lowering-costs-for-millions-of-americans-tackling-the-climate-crisis-and-creating-jobs/

Any idea when President Trump will cancel the Inflation Reduction Act?

LikeLike