This is a response from A. Reader to Mr Stewart’s comment at the post Middle powers must act together because if we’re not at the table, we’re on the menu.

At Davos, as esteemed Monarchs must, Presidente-For-Life Trump castigated Mr Carney.

To His Highness, renegade outbursts from Mr Carney, Chief Clerk of America’s Lowly North Colony, warranted stern demands for subservience.

Seeing an opportunity to confirm his status as a pragmatic if liberal revolutionary, Mr Carney suggested that it is unwise to make deals with maniacal felons.

For this, Carney was lauded worldwide and invited\disinvited from the newly invented shunned, yet prestigious, Board of Peace. It now consists of states that have their own reasons to be involved. None of those reasons relate to building a peaceful world order focused on fairness and equality.

As a result, under consideration is a new identity. The new name: BORED WITH PEACE.

As we all know, waging war can provide highly profitable business for well-positioned people. In peaceful time, economic benefits tend to be shared with everyone, something that repels the rich and powerful.

Let no one doubt that to America these are exceptionally impressive allies. Unless their citizens try to emigrate.

We have another example of Trump’s USA:

Federal immigration agents arrested and detained a Gresham family, including a 7-year-old child, outside a Portland hospital last week as the girl’s parents sought emergency medical care for her.

The arrest at Adventist Health hospital Jan. 16 took place less than 1,000 feet from the medical office parking lot where a Border Patrol agent shot and wounded a couple from Venezuela two weeks ago.

The family is in the USA legally.

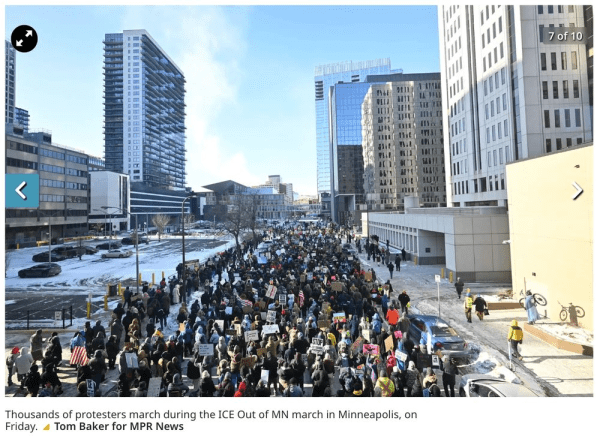

More than half of Americans are reasonable people. Some have taken to the streets.

Categories: International, Trump

I have long held the belief that the US dollar holds its high place as a reserve currency is because it has the ability to take whatever it wishes from the world.

What we have now is a classic example of that fact be it in Venezuela or Gaza.

TB

LikeLike

Mr. Carney’s Speech clarifies Politics

CUSMA? A trade deal authored by DJ Trump?

Mr. Frum vs Mr. Trump

Due to hurt feelings Mr. With Trump wants to impose 100% tariffs. CUSMA allows this?

Premier Doug Ford criticizes Trump?

https://www.msn.com/en-us/politics/international-relations/trump-threatens-100-percent-tariffs-on-canadian-imports-in-response-to-new-trade-deal-with-china/ar-AA1UTmGK?ocid=BingNewsSerp

President Donald Trump on Saturday said he would impose a 100 percent tariff on all Canadian imports coming into the U.S. if Canada follows through on a trade deal with China.

“If Governor Carney thinks he is going to make Canada a “Drop Off Port” for China to send goods and products into the United States, he is sorely mistaken,” Trump wrote in a post on social media, mockingly calling Prime Minister Mark Carney “Governor,” a nod to the nickname he had for former Prime Minister Justin Trudeau.

Saturday’s threat comes on top of an ongoing tariff dispute between the two nations that began early last year after the U.S. imposed broad tariffs on Canadian imports — 25 percent on many goods and higher rates on some other commodities — under national emergency trade powers. Canada then responded with retaliatory tariffs.

A number of these tariffs have remained in place, albeit with exemptions for many products covered by the United States-Mexico-Canada Agreement. Earlier this month, Trump said USMCA is something he doesn’t “even think about,” adding that “it expires very shortly and we could have it or not. It wouldn’t matter to me.”

https://www.britannica.com/money/beggar-thy-neighbor-policy

Although the precise origin of the term beggar-thy-neighbor is not known, Adam Smith, the Scottish philosopher who is also considered to be the founder of modern economics, made a reference to it when he critiqued mercantilism, the dominant economic system in Europe from the 16th to the 18th century. According to Smith, the doctrine of mercantilism taught that nations should beggar all their neighbors to maximize economic gains. Smith believed that long-term gains from free trade would far outweigh the short-term benefits that might be derived from the protectionist policies advocated by the mercantilists.

Economists after Smith confirmed his belief through research that showed that adopting such policies could trigger trade wars, a situation in which countries repeatedly retaliate against each other by raising tariffs on each other’s products. Trade wars tend to push the countries involved in them toward autarky, a system of economic self-sufficiency and limited trade, which could be detrimental for economic growth.

LikeLike

Heckuvajob Donnie!

More US bonds dumped by Sweden, China and Denmark.

https://thedeepdive.ca/swedens-largest-pension-fund-dumps-8-8b-in-us-bonds/

Sweden’s largest private pension fund has divested up to $8.8 billion in US Treasuries, marking the most significant withdrawal yet from American government bonds since President Donald Trump’s Greenland crisis erupted.

Alecta, which manages retirement savings for 2.8 million Swedes and 37,000 companies, sold most of its US Treasury holdings since early 2025 citing “increased risk and unpredictability in US politics,” business daily Dagens Industri reported Wednesday. The sell-off totaled $7.7 billion to $8.8 billion.

The move dwarfs Tuesday’s announcement by Danish pension fund AkademikerPension, which plans to dump $100 million in US Treasuries by February 1. Together, the Nordic divestments signal growing unease among European investors about America’s fiscal stability under Trump.

“This is connected to the decreased predictability of US policy in combination with large budget deficits and a growing national debt,” Alecta Chief Investment Officer Pablo Bernengo told Bloomberg.

The fund adopted “a staged approach” to trimming holdings over the past year, well before Trump’s Greenland threats triggered this week’s market turmoil.

Markets plunged on Tuesday after Trump refused to rule out military force to seize Greenland, with the S&P 500 falling 2.1% in its worst day since October. Trump reversed course Wednesday, announcing a tariff pause after meeting with NATO Secretary General Mark Rutte in Davos.

========================================================================

https://thedeepdive.ca/china-treasuries-gold-europe-wary/

China’s reported US Treasury holdings have fallen to about $680 billion, described as an 18-year low, alongside a stated rise in gold reserves to near 74 million ounces, and the pairing is being framed publicly as a deliberate rotation out of US paper into bullion.

Northern European investors are also reportedly increasingly wary of holding US assets. This comes after Sweden’s largest private pension fund has divested up to $8.8 billion in US Treasuries, marking the most significant withdrawal yet from American government bonds since President Donald Trump’s Greenland crisis erupted.

This is on top of another Danish pension fund reportedly planning to sell all US Treasuries by month-end.

The decision is repeatedly framed as a credit-risk call, including language that Treasuries have become “too risky to treat as an unquestioned long-duration anchor,” with the stated rationale tied to rising credit risk and linked directly to the current US administration.

The fund’s chief investment officer is attributed as saying US government finances are not “sustainable,” and the cited drivers bundle fiscal credibility and currency tone, including “weak fiscal discipline” and a “softer US dollar.”

========================================================================

https://www.forbes.com/sites/saradorn/2026/01/22/trump-says-us-will-have-total-access-to-greenland-but-doesnt-answer-ownership-question/

Trump Threatens Retaliation If European Countries Sell U.S. Treasuries—As Some Danish Funds Divest

President Donald Trump on Thursday promised “big retaliation” for European countries if they sell U.S. Treasury bonds in response to his threats to impose tariffs on NATO partners resisting his bid to acquire Greenland.

Trump made the comments on the sidelines of the World Economic Forum in Davos, Switzerland, telling Fox Business, “we have all the cards.”

Trump’s tariff threats—which he has since walked back—created speculation that European countries could sell off U.S. stocks and bonds as retribution.

The Danish Pension fund AkademikerPension announced plans this week to sell $100 million in U.S. Treasury bonds after Trump doubled down on his demands to absorb the Danish territory, and the Greenland SISA Pension has said it’s also considering divesting U.S. stocks, according to Bloomberg.

Swedish pension fund Alecta also told Reuters this week it’s sold most of its U.S. Treasury holdings over the past year amid volatility in the global political landscape under Trump.

Trump backed off the tariffs he threatened over the weekend after reaching a tentative deal Wednesday with NATO Secretary General Mark Rutte—though details of the plan are mostly unclear, and Trump has not directly answered questions about whether it includes the U.S. acquiring Greenland.

When Fox Business posed the question Thursday, he said, “it’s really being negotiated now, the details of it. But essentially it’s total access. There’s no end, no time limit.”

Contra

The majority of U.S. assets in Europe are held by private funds, not controlled by the government, and a sell-off would likely also negatively impact European investors, Bloomberg noted.

Big Number

$10 trillion. That’s how much in U.S. assets are held within the European Union, according to U.S. Treasury data.

LikeLike