More than a year and a half ago, the BC Government promised to end fossil fuel subsidies. But the second quarter report just issued estimates that royalty credits and infrastructure credits giver methane gas producers will amount to $495 million in the 2023-2024 fiscal year.

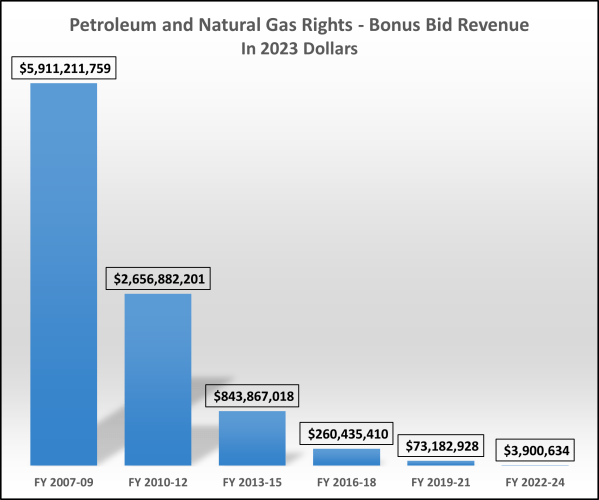

More importantly, the province’s report estimates the year’s revenue from bonus bids arising from the sale of petroleum and natural gas rights will be precisely zero dollars in the 12 months ending March 31, 2024.

Monthly auctions of rights were once a material source of revenue for the province. Government interest in competitive bidding for rights declined during Christy Clark’s time as Premier. John Horgan’s administration ended regular monthly sales, with only two auctions in Horgan’s last 32 months. In David Eby’s 13 months as Premier, BC has reported no sales of rights.

Subsidies come in many forms. The province could put money into the producers’ bank accounts, or it can reduce payments from producers that would have flowed into the treasury.

Many accountants believe the billions of dollars of benefits given methane gas producers should be reported as “tax expenditures.” The government has chosen not to do that, and Auditors General have not objected.

In early 2019, I discussed this matter with Carol Bellringer, then BC’s Auditor General. She offered no explanation as to why methane gas royalty credits were not counted as tax expenditures, even though she had issued a pertinent report months before we met in her Victoria office. It said:

Government chooses to provide certain exemptions, allowances, rate reductions, deferrals and nonrefundable credits from taxes that citizens and corporations owe. Each year taxpayers claim eligibility for these provisions. Known as tax expenditures, these forgone revenues represent money that government does not collect.

Because government gives up this revenue, it represents a cost in support of policy objectives. For example, the B.C. government, in support of its environmental policy objectives, does not charge provincial sales tax on bicycles. This example represented approximately $23 million in forgone provincial sales tax revenue for 2016/17.

Why do tax expenditures matter?

Tax expenditures are significant. They can exceed several billion in foregone revenue annually, in the case of provincial or state governments, and tens or hundreds of billion in the case of larger national governments.

Tax expenditures, together with direct spending, represent total government spending in support of policy objectives. And, as there is no requirement to report tax expenditures along side revenue and expenditure forecasts, tax expenditures may not be subject to the same annual budgetary review and approval process that applies to direct spending.

Governments in the last dozen years have been in love with megaprojects and the prospect of an expanded methane gas industry has had great political appeal. Of course, producers in BC are happy. Spending a few million on lobbying politicians and senior bureaucrats has saved billions.

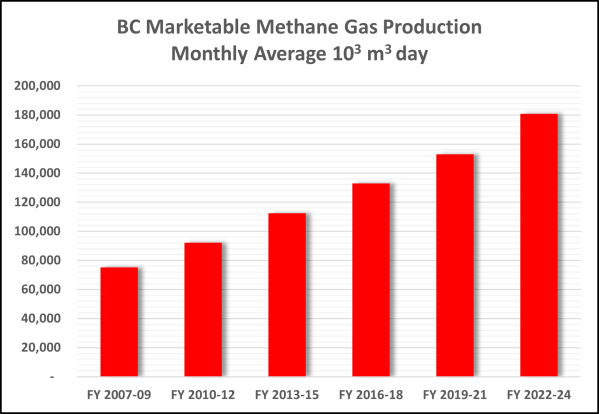

Gas producers’ payments to the province may have changed but notice how production has steadily increased. Before the 2017 election, BC NDP promised the public would gain a fair share of natural resource revenues. NDP quickly forgot that pledge.

Auditor General Bellringer’s comment that less attention is paid to indirect fossil subsidies is valid. Political pundits working in BC Media have little interest in reporting information like that found in this article. The government and the official opposition are even less willing to discuss these issues.

People old enough to remember media obsession with BC’s fast ferries may wonder why a few hundred million was so important years ago, while media ignores billions of forgone revenues benefiting fossil fuel producers today.

If you find value in posts and dialogue at IN-SIGHTS.CA, please consider financial support. It is a simple process explained HERE.

Categories: Fossil Gas

I suspect part of the reason media have stayed away from this story is because it’s so complex and hard to convey to the general public (many of whom have no interest in the first place. None.)

Today, I heard that the Vancouver Parks and Recreation is going to charge minor baseball $5.00 per hour for diamond rentals — more than double the old rate. The baseball club figured it will cause a yearly rise of $7,000, which will be passed on to parents.

That’s a simple “nickel-and-diming” story of a subsidy, or tax exemption, that is being squeezed to generate more funds for the parks board. And it won’t just be minor leaguers who will get hit. Expect all rentals to take a jump, along with parking and permit fees.

While a much bigger budget, the Fast Ferries story was still a fairly easy one to tell — especially when it favoured one political party over another.

I commend you, Norm, for your years of shining the spotlight on the complex BC Hydro and BC oil and gas files. Your graphs, cartoons and examples help build our understanding of the issues.

LikeLike

Thinking out loud: now that carbon tax is no longer “revenue neutral” and is just rolled into government coffers… has carbon tax replaced the lost revenue from oil and gas extraction?

LikeLike