Share this:

- Email a link to a friend (Opens in new window) Email

- Share on Pinterest (Opens in new window) Pinterest

- Share on X (Opens in new window) X

- Share on Bluesky (Opens in new window) Bluesky

- Share on Facebook (Opens in new window) Facebook

- Share on Reddit (Opens in new window) Reddit

- Print (Opens in new window) Print

Related

Categories: Taxation

Im sure I heard Christy spouting off about record growth in mining in BC the last 10 years, I guess if I was a miner I would open up a mine where the government lets you keep all the profits, destroy the environment with no consequences and lets you bring in workers from off shore who will work for peanuts.

LikeLike

I'd like to see the same graph — but using actual dollars instead of % changes. Actual dollars is a more direct way of representing the changes — though inflation should be factored in, I imagine.

For example: if medical premiums went from $1billion to $1.9billion, they went up by 90%. If resource revenues dropped from $50billion to $35billion, they went down by 30%… but the resource dollar loss is far greater than the MSP premium increase.

LikeLike

D'oh! I seem to have shortened my name today. Please adjust it.

Cheers.

LikeLike

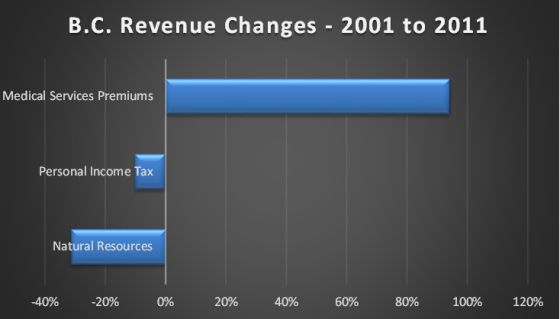

I think the graph speaks louder than words Norm. Out taxes decreased but premiums and service charges went up more significantly than the tax decrease. Give you a little but take a lot in charges but don't you dare call it a tax increase!

LikeLike

The government giveth with one hand but taketh more with the other.

LikeLike

The Campbell/Clark BC Liberals have been ripping us off, for well over a decade now. Christy bumped up the cost a living again this year.

However. It was Harper's Omnibus Bill that gave China the right to sue any Canadians, who try to block China in any way. China sued in BC to take the mining jobs. Of the seven new mines and mine expansions. China will bring their own miners with them. The American owned mines, will do the same. We do not have the right to the resource jobs. We have very few rights left, what-so-ever.

LikeLike

Thanks for putting up the graphic, Norm. A picture's worth millions of words about billions of dollars.

The spike in MSP premiums plainly coincide with Campbell's retrogressive tax personal tax cut. It would be interesting to see what other non-tax revenues also spiked during this time, things like licensing fees (my DL cost $25 to renew then, $75 last I renewed), all manner of permit fees, maybe even throw in provincial park parking meter revenue that citizens didn't have to pay prior to the personal tax cuts.

We analysed our kids' tax burden for the first year of Campbell's cuts: the net effect including fees and MSP premiums was an 4% increase of burden, this for a young family with two babies and very modest self-employment incomes. Nobody in our family was fooled by the revenue shell game.

LikeLike

Loved the graph. it says it all. Now if the income from taxes and mining were restored to the former level B.C. might not be in such a financial mess. O.K. we'd be in the mess but we might have some more money to get out of it.

LikeLike

Norm, could you tell us where these were sourced from?

LikeLike

British Columbia Public Accounts, published by the Finance Ministry.

Even with this massive reduction in natural resource revenues, the province's deficit is understated because $702 million owing to gas drillers has not been recognized despite the fact it should have been booked under public sector accounting standards.

Auditor General John Doyle had this to say, among other reservations he expressed:

No provision has been made in the summary financial statements for royalty credits earned by

natural gas producers under the government’s deep-well drilling program. In this respect the

summary financial statements are not in accordance with Canadian public sector accounting

standards.

Had a provision been made prospectively, as required by Canadian public sector accounting

standards when an issue is raised by an auditor in one period but not corrected until a subsequent

period, accounts payable and accrued liabilities as at March 31, 2012, would have been greater

by $702 million, natural resources and economic development expenses for the year then ended

would have been greater by $702 million and the deficit for the year then ended would have been

greater by $702 million.

LikeLike

Contrary to the statements of Bill Good, Shachi Kurl and especially Bridgitte Anderson and Alise Mills, we don't make up facts here as they do in the BC Liberal world.

LikeLike

Thanks for the quick response on the second graph, Norm. I was just throwing numbers around — but see that I was scary-close on my guesses about the MSP premiums.

Interesting that the personal income tax is such a big source of funds.

LikeLike

Glad to receive suggestions from regular readers. You made a good point.

LikeLike

I lost hundreds of dollars because of no deductible at all in 2012 even on very low income.

LikeLike

Sorry that should read no deductible on Pharmacare. Seniors very seriously affected.

LikeLike

Could you recommend a source for BC MSP Premiums, from say….. 1995 to 2013, for a Family of Two Adults, Two children? I've got one document (published in 2005)… coveriing from 1992… 1996 up to 2002, but I'm looking for more data.. BC Liberal Government doesn't seem to want to share the data….

LikeLike

North Van District Public Library, facilitates online research, providing access to a variety of databases including newspapers, magazines and other sources. Other libraries will provide their members with similar access to resources.

LikeLike