Today, charts about BC Hydro showing information that ought to alarm citizens of British Columbia. It will not of course, because corporate media does not bother to report meaningful data about the province’s largest crown corporation. Despite their continuous claims that demand was growing by 40 percent over 20 years, the company’s own sales records show that demand was slowly growing until 2005 and since then has been stable. But that fact did not prevent the utility from amping up their spending machine.

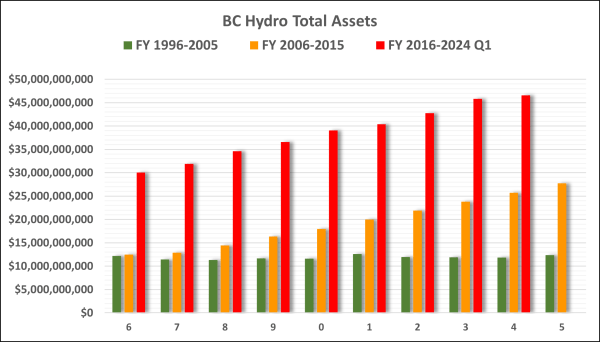

Demand may have been flat, but stable is not how we could describe BC Hydro’s asset base.

Note that in the first decade (green FT 1996-2005), assets employed to meet growing demand remained the same. When demand flattened, asset growth took off. So did debt.

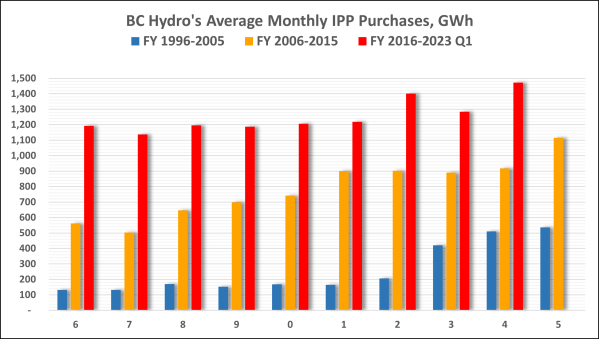

In addition to its huge spending on assets during years of flat demand, BC Hydro’s purchases from independent power producers soared.

If you find value in posts and dialogue at IN-SIGHTS.CA, please consider financial support. It is a simple process explained HERE.

Categories: BC Hydro

Quebec blue gold fund (water). Does BC have anything like this?

The Generations Fund (Quebec)

The Act to reduce the debt and establish the Generations Fund was passed on June 15, 2006 with the goal of reducing Québec’s debt burden.

The Generations Fund is a fund dedicated exclusively to repaying Québec’s debt.

In order to finance the Generations Fund, we have turned to our most important renewable collective resource: water, Québec’s blue gold.

The Generations Fund is financed by revenue sources dedicated to debt repayment and consisting of, in particular, water-power royalties from Hydro-Québec and private producers of hydroelectricity.

The Generations Fund also receives sums relative to the indexation of the price of heritage electricity, an additional contribution from Hydro-Québec, mining revenues, the specific tax on alcoholic beverages and the liquidation of unclaimed property administered by Revenu Québec.

The sums dedicated to the Generations Fund are deposited with the Caisse de dépôt et placement du Québec and managed in accordance with an investment policy determined by the Minister of Finance in collaboration with representatives of the Caisse.

THE GENERATIONS FUND WILL STAND AT $19.1B AS AT MARCH 31, 2023

LikeLike

Quebec’s Generations Fund is more a public relations gimmick than a program of using resources to create value for future generations. Norway, with population less than 2/3 of Quebec is serious. It has a national wealth fund of C$1.9 trillion (C$347,000 per capita). Quebec’s $19 billion (C$2,150 per capita) is not impressive by comparison.

The Globe and Mail reported on the Generations Fund in 2018:

BC takes water rentals into general revenue, as it took billions of dollars of BC Hydro profits. There is no accumulation to benefit future citizens.

BC passes the main benefit of low cost heritage electricity to corporations. While BC Hydro is buying electricity from private producers for nine plus cents per kilowatt-hour, it is selling, or has promised to sell, power to LNG, oil and gas, and mining companies, for a fraction of its marginal cost from new sources. (Site C will cost between 15 and 20 cents per KWh.)

The political justification for selling electricity to corporations below cost of new power is that output from from heritage facilities is inexpensive. However, businesses that sell inventory based on average cost, instead of replacement cost, are soon in trouble.

LikeLike

Hello Norm and others; It may help readers if I introduced them to H. von Mises. He was a prominent economist from Austria and the founder of an economics school of thinking. Among the topics he had thought on was the idea of unlimited credit expansion. The topic was captured by his phrase, “Final Collapse”.

A recently published book sort of echos some of the von Mises thinking and has the title “Dawn of Everything”.

Like all things that ultimately matter the greatest, these topics are akin to “watching paint dry”.

LikeLike

Yes Norm but do citizens realise the debt load is deliberate by the “buyers” of what we produce, commodities?

“Confessions of an Economic Hitman” describes the process. The Buyers want inexpensive commodities so they encourage the producers to expand production at the cost of more debt. This happened in South America and now their economies are in ruins.

BC fell into the same trap set by Japanese need for inexpensive coal. Contracts were reneged on so we were left with “stranded” assets. Buyers of Beaufort natural gas tried and failed to trap TPL but Dome Pet. was one casualty. People in Newfoundland fell into this financial trap when they went ahead with Lower Churchill Falls. BC is now doing it with the building of Site C .

The rule that buyers take prices higher and sellers take prices lower. That is why buyers work hard at increasing the debt of primary producers as a way of creating desperation at the producer stage.

LikeLike

Quite right Erik. I have a copy of John Perkin’s 2016 update, The New Confessions of an Economic Hit Man. I expect to write about the book here soon.

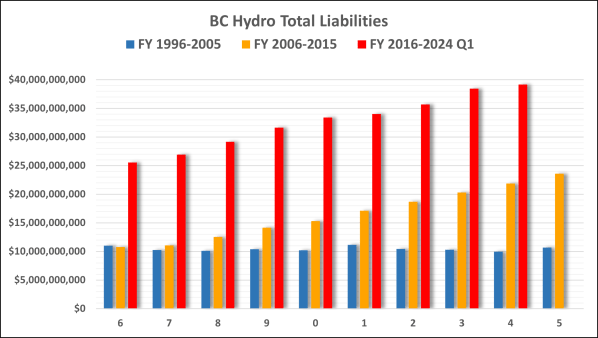

I added two charts showing BC Hydro’s total liabilities and the company’s contractual obligations. The latter is mostly the amounts owed independent power producers.

Somehow the wizards running BC Hydro thought it was prudent to oblige the company to pay almost $60 billions to IPPs and to add about $30 billion in liabilities. All during a long period of flat demand.

It still amazes me that this information is of little interest to corporate media.

LikeLike

Money pits abound in BC. Translink is currently $4.7 billion in the hole. you know, billion here and a billion there, mere chump change to politicians and bureaucrats.

LikeLike

Would you believe that Hydro’s board of directors has been locked in a room since 1989 forced to watch Field of Dreams, ‘build it and they will come’, and eat nothing but popcorn for that entire time?

LikeLike